Another Warning Sign for Market Vulnerability

Another indication risk is higher than you might think. Issuance, IPO and secondary, is at a historical high. Maybe the CEOs know something about valuations and fragility that we do not.

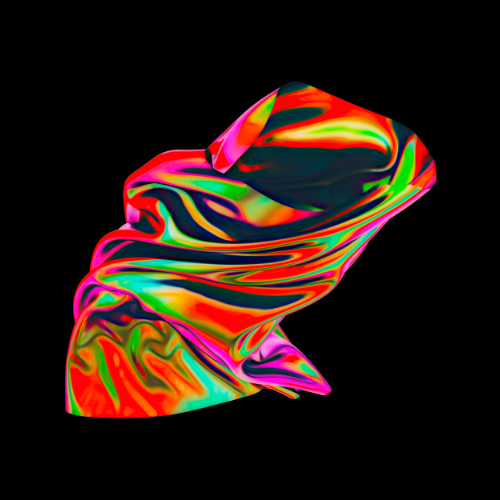

You can spot a vulnerable market through various indicators: technical — high concentration; fundamental — record P/Es; and macro — tapering. Add issuance to those. Issuance — IPOs and secondary — is now at an all-time high. The runner up: The period right before the pre-Internet bubble. Not a good sign.

.jpeg)

The chart shows issuance history, IPO in green, secondary or seasoned issuance in blue. Think of high issuance sort of like high insider selling. Both will occur when the perceptions within the company are that things are overpriced.

This rise in issuance has been pointed out by GMO, whose prescient co-founder Jeremy Grantham is about as negative on the market as anyone.

Just to be clear, I am not making the argument here that he is, namely that the market is due for a crash of epic proportions. Rather, I am willing to limit my argument to the risk in the market; to its vulnerability. Risk is higher than the standard risk measure — which is a simple calculation of historical volatility — suggests, and higher than the current market suggests.

Speaking of IPO issuance, I have already written about SPACs, a form of IPO that has exploded into view. [https://go.fabricrisk.com/rb-spacse] Think of the higher issuance as taking the problems there and pulling things back into the world of standard stock issuance. That is, pulling away the veneer of “innovation” that makes SPACs a two-fer as a problematic signal for market vulnerability.

See Jeremy's January piece, Waiting for the Last Dance for the best pessimistic view of the market or his segment on WealthTrack.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk