Bank Failures

Why is this less systemic than in 2008?

Are we done now? Can we wait it out as the dust settles? Jamie Dimon, carting First Republic off to the taxidermist — big game trophy of a lifetime. -- said the crisis is now over, then revised to add “this part”.

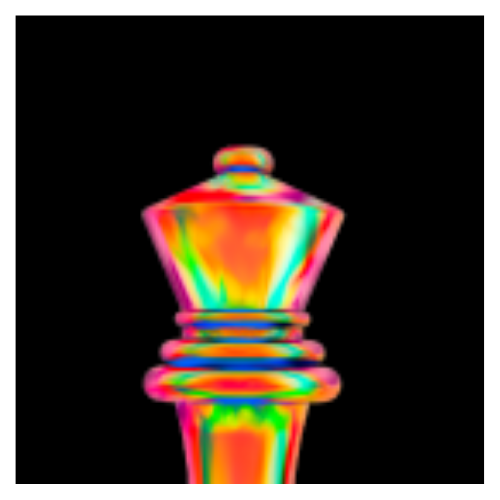

By some measures, like this one, what we are seeing now is as bad as 2008.

.png?width=682&height=493&name=Untitled%20design%20(26).png)

But in fact it isn’t. Why is this less systemic than in 2008?

It has to do with the paths of contagion. What we have now can be bad, hitting commercial real estate, where the office sector is already down and out. And it will hit small businesses that rely on these banks for credit. I don’t think JP Morgan is going to be the substitute for your town’s dry cleaner of gutter fabricator.

Key concerns

1. Commercial Real Estate.

Commercial real estate loans have been growing a lot over the post-Covid period, and make up around a quarter of an average bank’s assets.

Many of these will come due in the next few years, and if rates remain high the risk of default will rise. The high rates also depress the value of commercial properties, increasing owner defaults.

2. Small Businesses.

When the Fed increased rates to the current level in 2007 lending dropped by around 5%. And this time around it will settle mostly on the regional and smaller banks that small businesses rely on. So they then reduce lending. It is already happening, as this chart shows:

So we have some of the the same sort of issues now as in the 2008 crisis. Residential real estate then versus commercial real estate now. Large businesses starved for credit and thus cutting back inventory then, rather than that local dry cleaner now.

But this banking crisis is like a flesh wound. A wound that might get infected, so ongoing risk, but what happened in 2008 was like a stroke, blood cut off the the core of the financial system. Short-term funding, repo and the like, is the lifeblood of the financial system. And that is what was at stake.

Things could get bad, but I don’t think anything we face will match 2008, where the issues hit at the center of the financial system and burrowed into the foundation of the economy.

One thing that is the same: regulators asleep at the switch. Here is an article I wrote for the Financial Times on the failure of regulators in this crisis. Same as 2008. Which is not good.

Source for illustration: FDIC by Karl Russell

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk