Consumer Confidence

There is rising risk in the market.

I am really not in the business of trying to predict a recession. Though it is tempting. But what I will say is that there is rising risk in the market. I also am going to say that if you are using typical risk metrics, you will be getting it wrong. Such metrics look at risk today by taking the standard deviation of returns over the past year or two. Clearly what is happening now is not like what has been going on over the past two years.

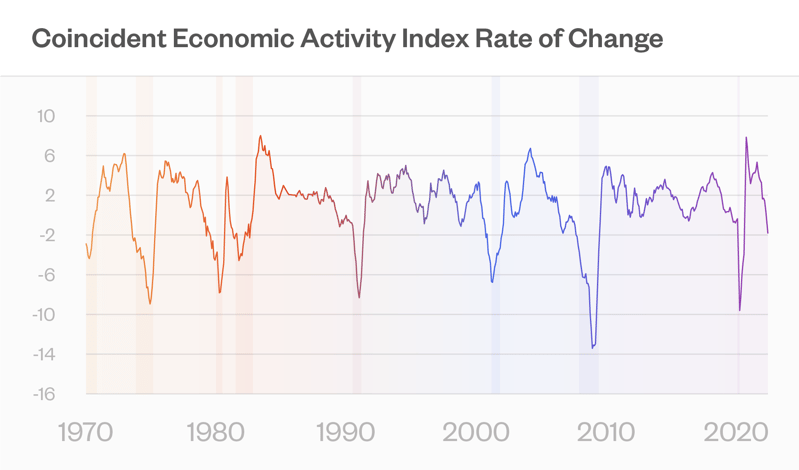

Here is a measure that has predicted eight of the last eight recessions, with no false positives: the rate of change of the Conference Board’s Coincident Economic Activity Index. It has dipped below -2 for each recession and never has gone below -2 without a recession.

Right now it is hovering right at -2. Does that mean a recession? You decide. But whichever way you go, clearly it does highlight vulnerability in the market.

Granted, if you look at ten or twenty economic indexes, there are good odds that one will get eight out of eight. But still, there it is. And for the skeptics, here are other indexes that underscore the recession risk at this point. And suggest not looking at current market risk through the rearview mirror:

The Conference Board’s Business Expectations Survey is at its lowest level since 1980,

The University of Michigan’s Consumer Confidence Survey is at the lowest level since 2010.

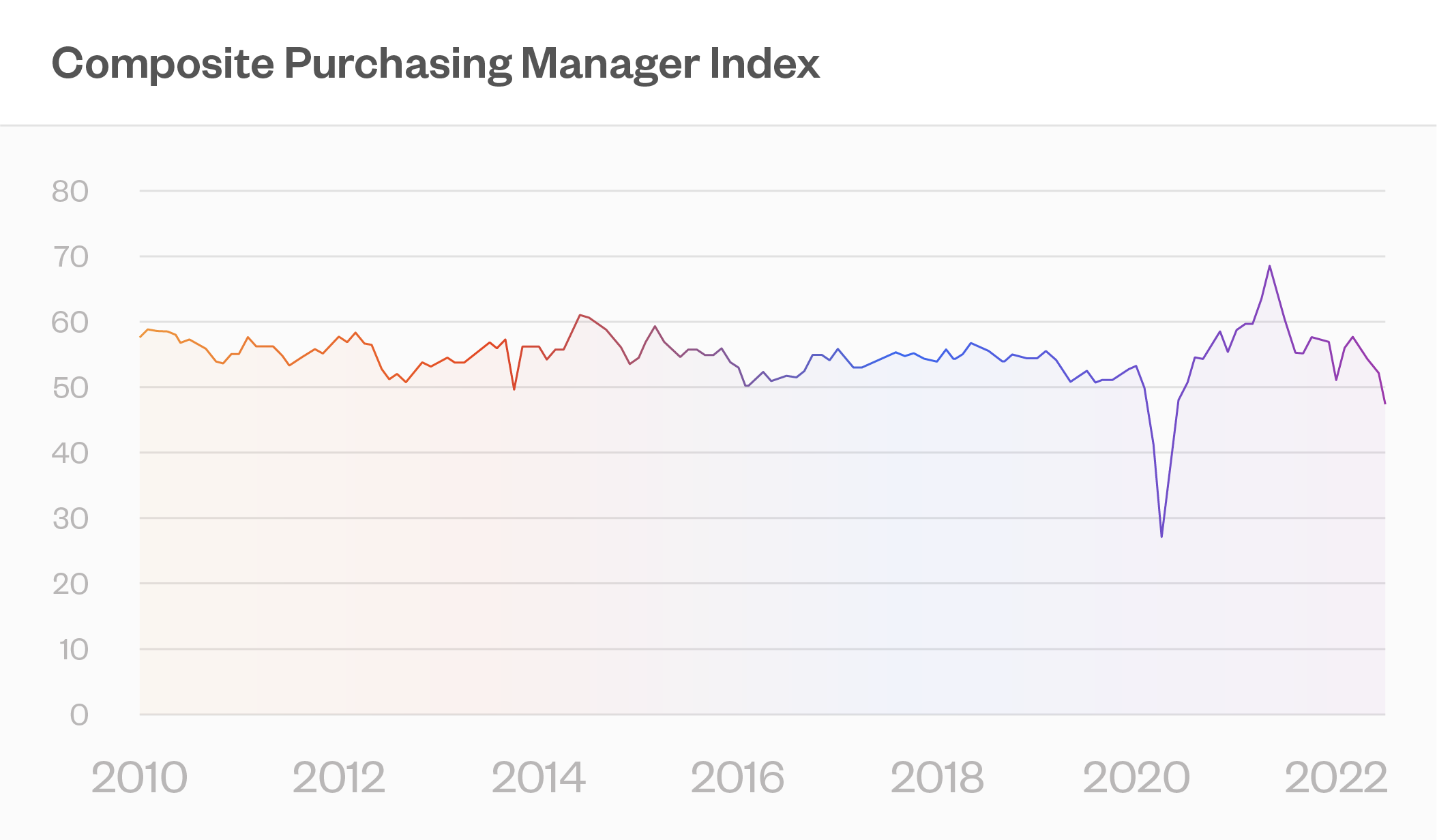

The Composite Purchasing Manager’s Index is at the lowest level since 2010, excluding the major drop on March of 2020,

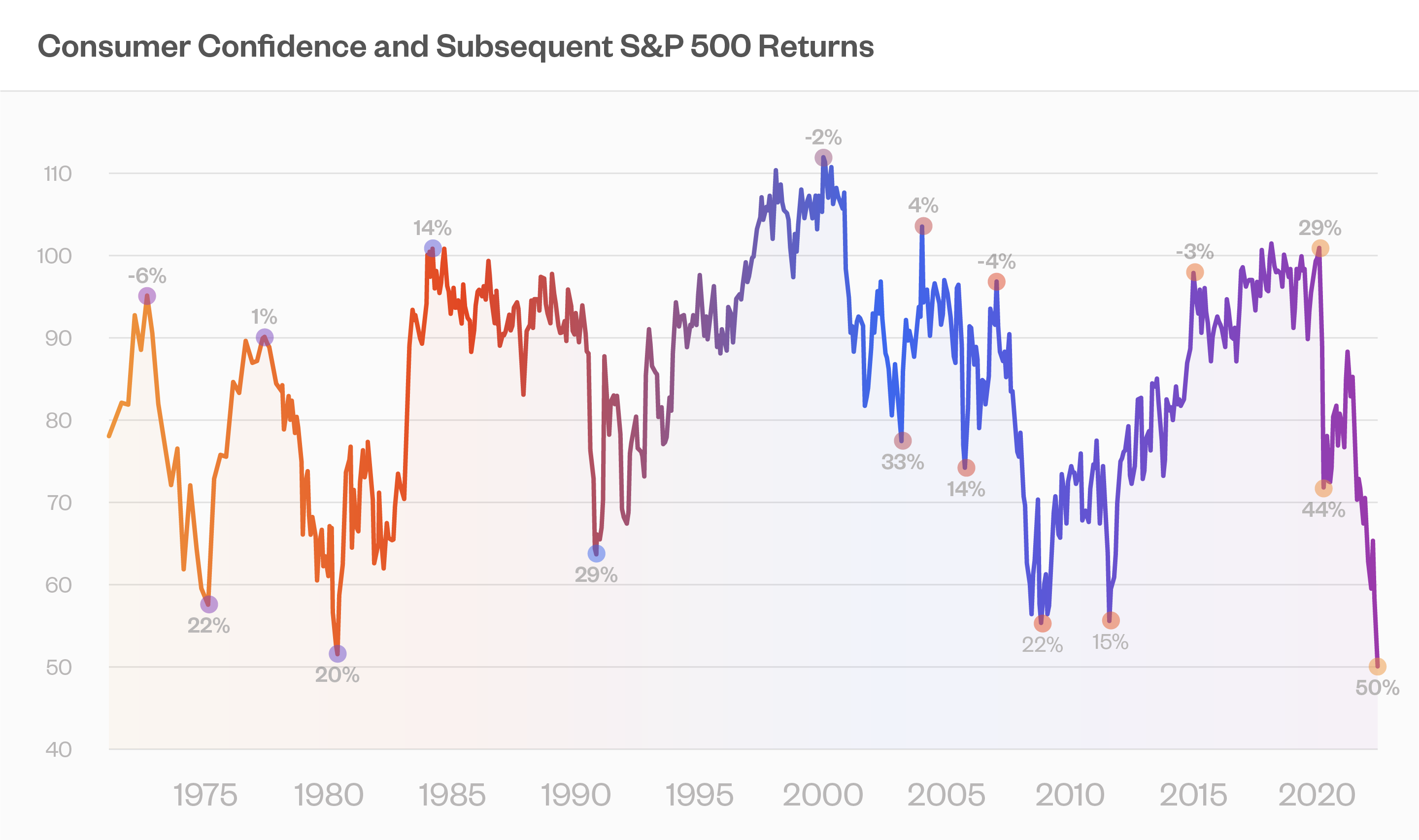

For an interesting factoid on the Consumer Confidence Survey, check out this chart. If you had bought the S&P 500 at each of the eight troughs since 1970 you would have made 25% on average over the following year, compared to making 4% if you had bought at the eight sentiment peaks.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk