Credit Standards

There is credit risk building up under the covers.

Look at this chart for the spread between BBB-rated bonds and the spot Treasury. It seems like business as usual.

But there is credit risk building up under the covers.

Granted we are not in a recession, and many are seeing the risk of recession waning. More important for the markets, everyone knows recession risk is there; it has been baked into the markets. Which is part of the problem. The risks that really matter to the market are ones that have not been identified or appreciated. One of those is credit.

Many businesses have built up over the past years on the sand of free money. That’s going to come to the fore now that we have higher rates, A bigger issue is that many business won’t be able to refinance even if they can take on the higher rates because the lending standards have tightened.

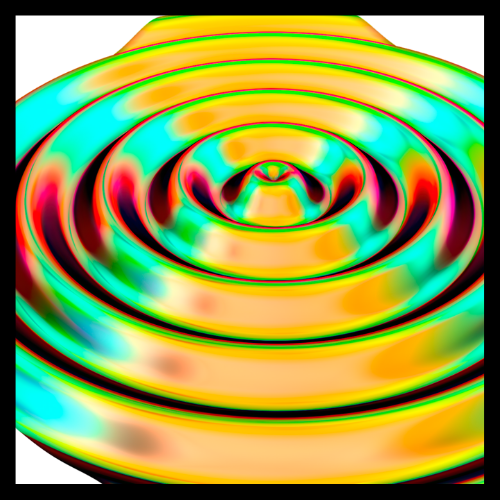

As this chart shows, lending standards (as measured by the Fed) have increased sharply. And, looming recession or not, have risen to the level of previous recessionary periods.

So keep an eye on credit risk, and don’t only look at spreads: Which companies are the walking dead? Which of those companies has yet to be ferreted out?

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk