Deglobalization

New to the lexicon: Friend-shoring. And with it a new dimension of market risk.

“Friend-shoring” was coined in a 250-page White House report last year that focuses on the need to direct our supply chain toward our allies. The importance of doing this became white hot with Russia’s actions over the past six months. And that it will go from a report to a reality is now all the more apparent given a speech last week by Janet Yellen.

A shift like this has implications for the market, and so demands a market scenario. Here at Fabric, we are engaged in developing a risk scenario based on this route toward de-globalization.

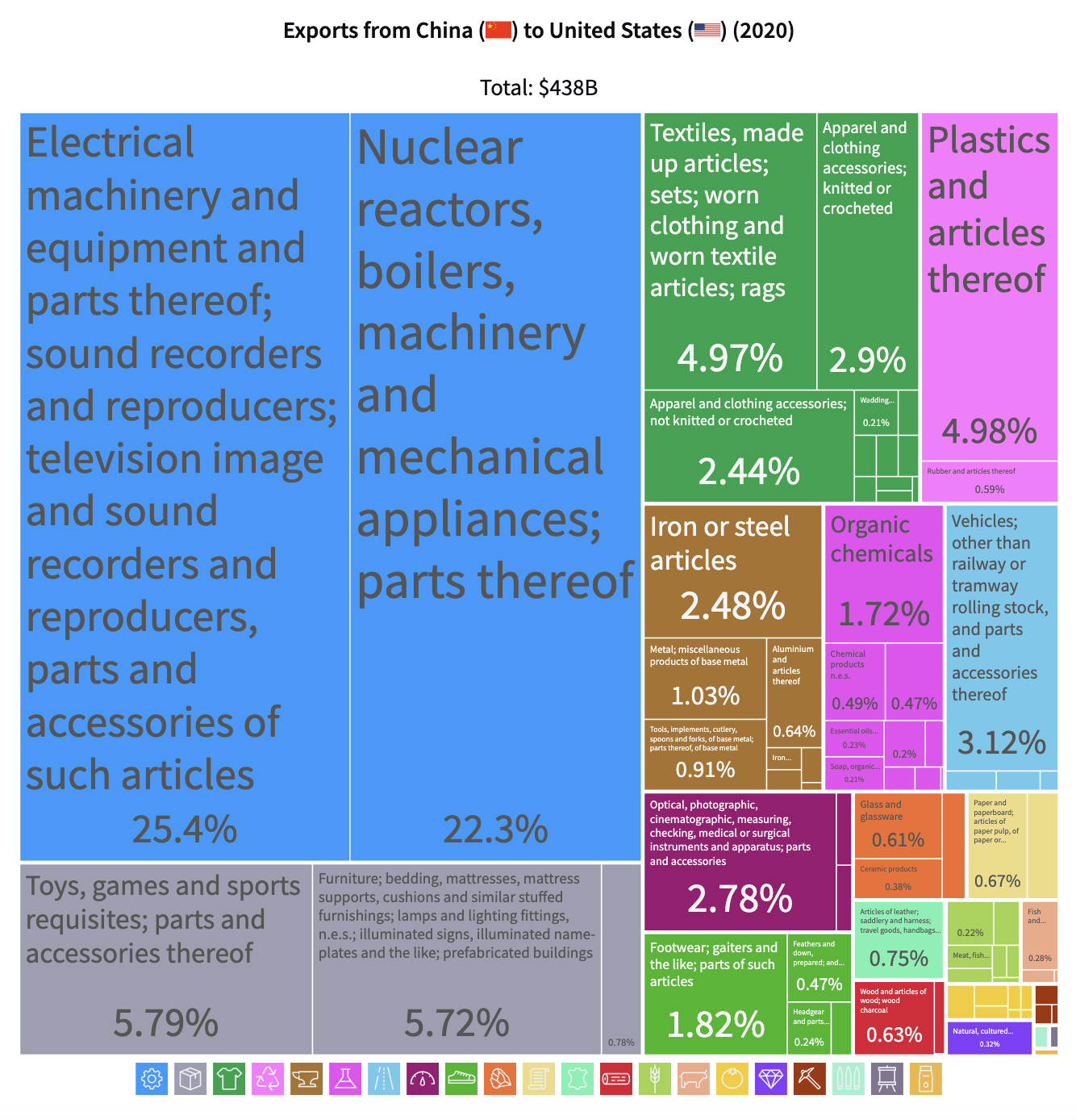

There is a lot to do to build the scenario, but at a 30,000 foot view, what changes in the risk landscape as the U.S. moves toward friend-shoring? A good sense comes from this figure, taken from a great source, OEC, that shows where the focus is in our supply chain-related imports from China. At a detailed level, it is things like:

Data processing machines and parts

Transmission apparatus and parts for broadcasting

Textiles and related supplies

Of course, China won’t be the only country affected, but the methodology for China will apply for other countries. And what is bad for China is good for, say, South Korea, so a similar view can be done for them and for their industry focus, but on the plus side.

Why am I focused on this now, given the report itself is old news — out a year ago?

Well, one thing I learned from my time at Treasury is that speeches by the Secretary are not off-the-cuff. If Janet Yellen says we are going to divide the world, roll back globalization, and stick it to China, that is what we are going to do. Which she did say. Maybe I should add, “in so many words”, because another thing about high-level speeches is they are hazy on specifics. Though notably in this case, not too hazy.

The key focus is building a more secure supply chain: Working with allies and partners through what she called “friend-shoring”. “Friend-shoring is about deepening relationships and diversifying our supply chains with a greater number of trusted trading partners to lower risks for our economy and theirs.”

And, can you have friend-shoring without also having “Enemy-deshoring”? These would be countries that she describes as authoritarian regimes that use economic clout to extract concessions and undermine the rules-based international economic order, that put democratic governments at the mercy of “bullying by authoritarian leaders”.

Of course, this is motivated by Russia, but for all the current consternation, there are bigger fish to fry. We are not kept guessing for long about who she has in mind:

“One such example is China, which has directed significant resources to seek a dominant position in the manufacturing of certain advanced technologies, including semiconductors, while employing a range of unfair trade practices to achieve this position.”

In case we missed that, Yellen also says, “We cannot allow countries like China to use their market position in key raw materials, technologies, or products to disrupt our economy or exercise unwanted geopolitical leverage.”

One other thing about high level speeches: We don’t blindside our allies when they are being invoked. So you can be sure our key allies are on board — for sure Korea and Japan, given that the speech was delivered in South Korea.

The U.S. is laying it on the table.

What does China think of this? Will they shrink into their own sphere of economic influence? Will they wait until our system of political musical chairs puts someone else at the helm? They shouldn’t hold their breath for that; this is one area where most Republicans, Trump included, share Yellen’s view.

Oh, and add a checkmark to the “good timing” column, because three days after her speech CNN reported that Huawei has given sweetheart deals to some rural areas in the mid-West to supply them with communication equipment, that, it turns out, can listen in and disrupt military bases — including ones with nuclear response capability — that happen to be nearby.

So we build “strong bilateral ties with friends” while closing ourselves off to authoritarian regimes. We “take a long-term view of the vulnerabilities in our economic relationships.” We make the United States and our partners safe from the “arbitrary and politically motivated economic coercion”.

From a risk standpoint, we need to consider the market impact of a world order with bifurcated globalization. The risk prospects for winner and loser countries, winner and loser industries, and how that plays out in risk factor space.

Here is the source for the charts: https://oec.world/en/profile/bilateral-country/chn/partner/usa?depthSelector=HS2Depth

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk