Falling Dominos

Dominos are lined up to be the prime mover or to create a cascade:

In the TV show House, a patient comes in with a mysterious ailment, and one by one — usually right before the commercial break — other ailments appear, each more serious than the first. Something along those lines happens to the real-world market as well. On bad turn layers on another.

Crises often arrive in packs because when a crisis hits, it increases the vulnerability of the market. So an event that might not have been problematic in normal times knocks the market another leg down. Or pushes the market underwater just as it is getting back up to the surface. I have recounted the ultimate result, lost decades, elsewhere, and link to it below.

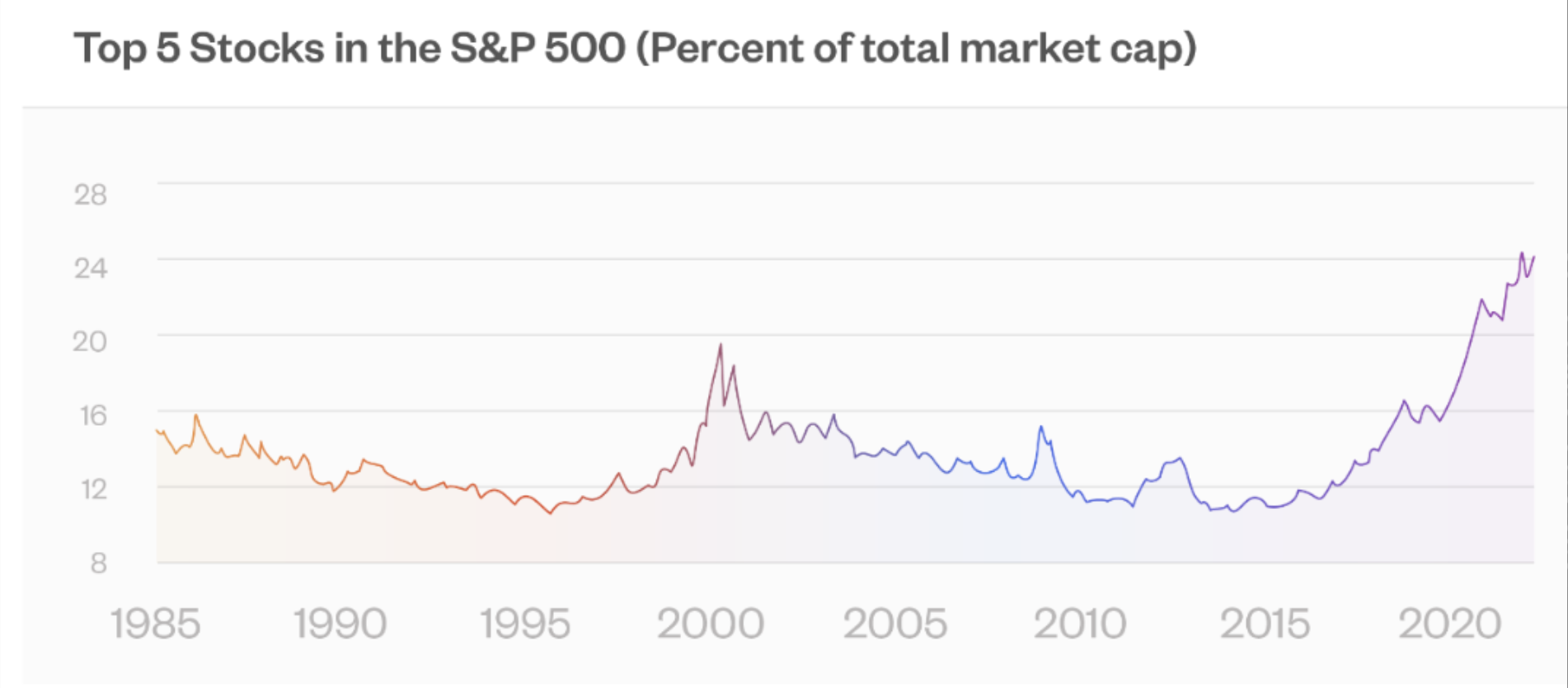

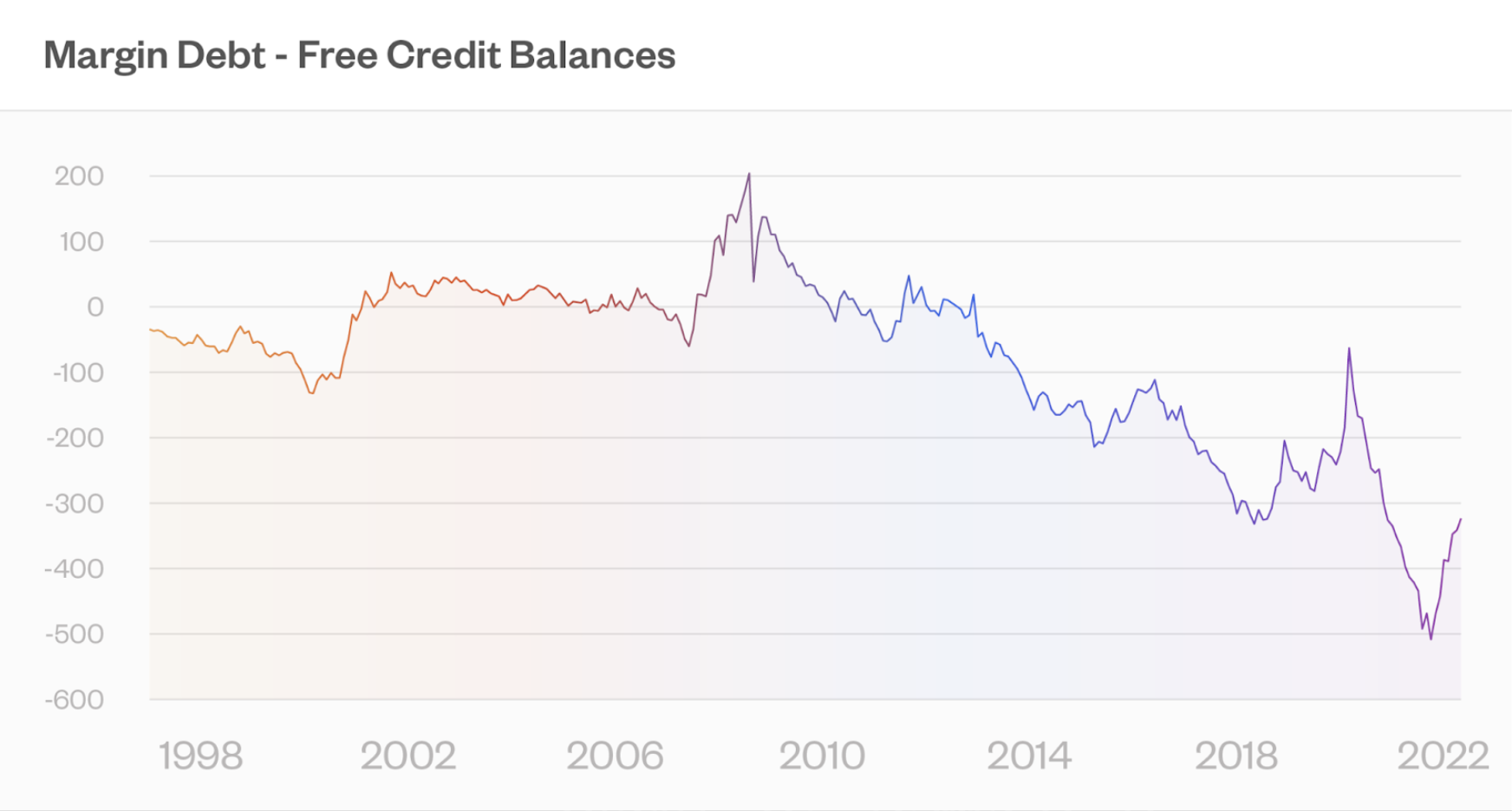

We face this now because we already have a vulnerable market. High concentration and leverage, as shown in these two charts.

There also is not a lot of dry powder to meet liquidity demand. Households, for example, already have record high investment of equities as a percent of their total liquid assets. They are not going to be in the market to sop up the overflow of liquidity demand if the market tumbles.

There are a number of dominos lined up to either be the mover or to add to a cascade: Inflation, recession, the two combined for stagflation, tech still sitting well above long-term fundamentals, geopolitical risks, quick-burn with Russia, smoldering with China.

To give a sense of this, the chart below shows the market downturn post-2000. There are three legs down. These largely can be pinned to three crises events. The first was a delayed response to the bursting of the TMT dotcom bubble. This then woke people up to the crazy valuations that extended beyond TMT and dotcom. And this then was followed by a rethinking of earnings after the earnings-centered fraud of Enron and others.

The same happened between 2007 to 2013, and also over the course of the 1970s. In those cases things almost got back to even, only to dive down again.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk