How Low Can You Go?

Leverage, liquidity, concentration, and valuation.

How low can you go? Not Ludacris, Chubby Checkers. But not the limbo, tech. Markets are dynamic, risk is as well. With the downturn in tech, is risk lower or is it heightened? First obvious point: there is less of returns to erode for any notion you had for a bottom. But the bottom is a moving target. And the trajectory to that target also changes with the nature of the market.

I’ve focused on key vulnerabilities in the market that give a sense of how violent a market break can be: Leverage, liquidity, concentration, and valuation.

So as a start to what we might expect, we can see if these vulnerabilities are becoming buttressed.

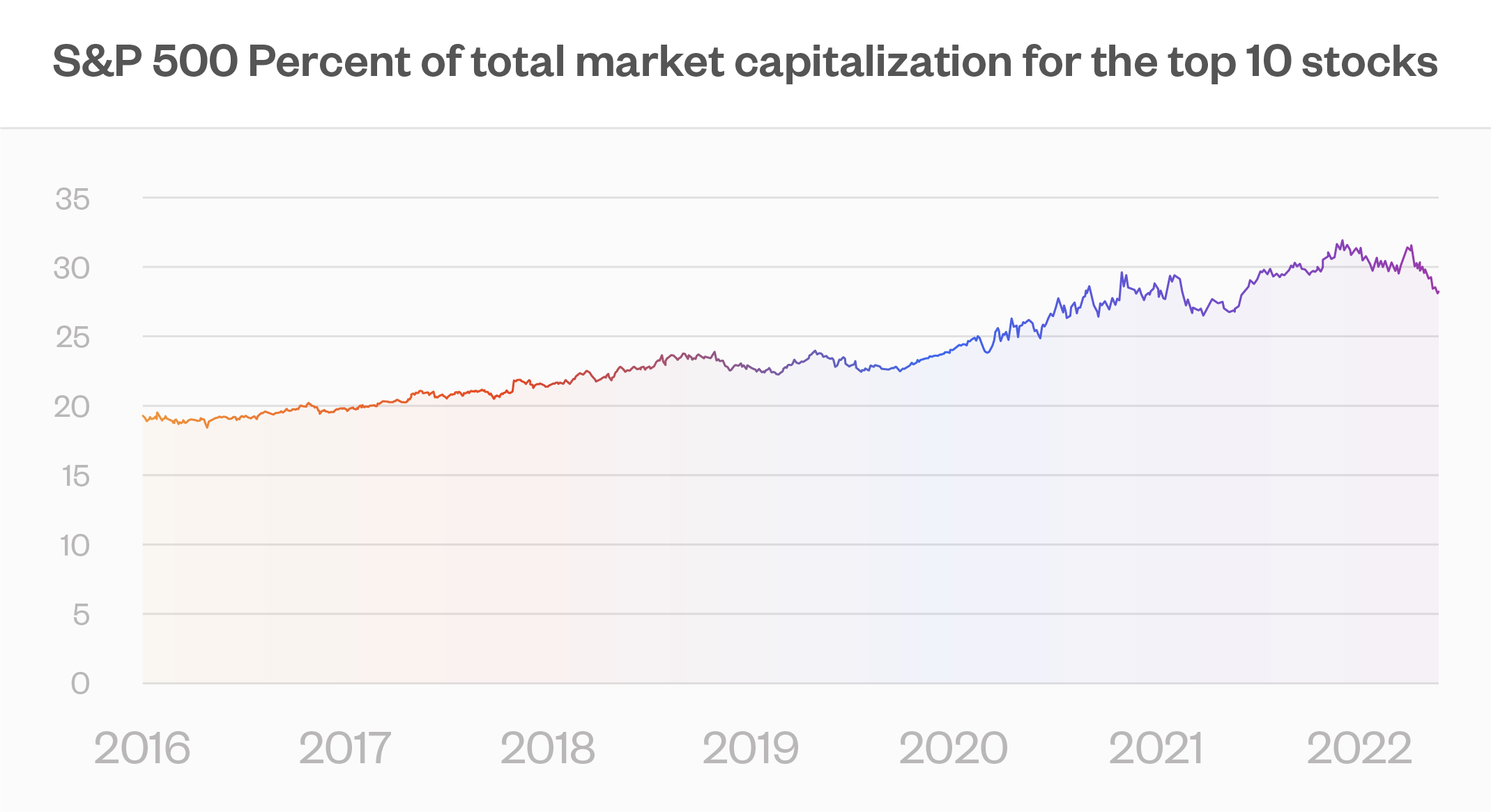

The chart below focuses on one of these: Concentration. At one point in the recent past the top ten stocks in the S&P 500 made up nearly a third of the index’s market capitalization. A rule of thumb is that concentration above 20% is, say, DefCon 3. As the chart shows, we are moving down, but not there yet. Note that this does not relate to the market broadly speaking, it is a relative measure of how much heat is dissipating from the most concentrated part of the market.

For the other areas:

Valuations are coming back to earth. The median P/E for the S&P 500 has moved down from a high of 33 to 24. Looking back for the past 50 years, the median value of the P/E is 18.

Leverage as measured by margin debt less free credit balances is down nearly 40% from its high.

Liquidity is a wild card. If you are betting the Fed will intervene, it is high. My money is on that not happening. March of 2020 or the Fall of 2008 are one thing. A once every decade or so market downturn is something else. Absent that, liquidity is low because there is not a lot of dry powder left.

Bottom line, the air is coming out, and in the grand scheme of things in an orderly way — though in downturns “orderly” is more like “not panicked”. And over its course risk is dissipating.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk

.png)