Diversification

Diversification is the most powerful concept in finance. It is the reason we are encouraged to hold portfolios of many stocks. And by the time you have 500 stocks in your portfolio, you are just about as diversified as you can be, right?

Well, take the S&P 500. While it holds many stocks, it does not hold a small amount of each stock.

Obviously, if you hold, say, 500 stocks but 90 percent of your money is in one of them, you are not going to get much benefit of diversification. While not so dramatic, this is what occurs with most indexes, because the stocks are held based on their market capitalization.

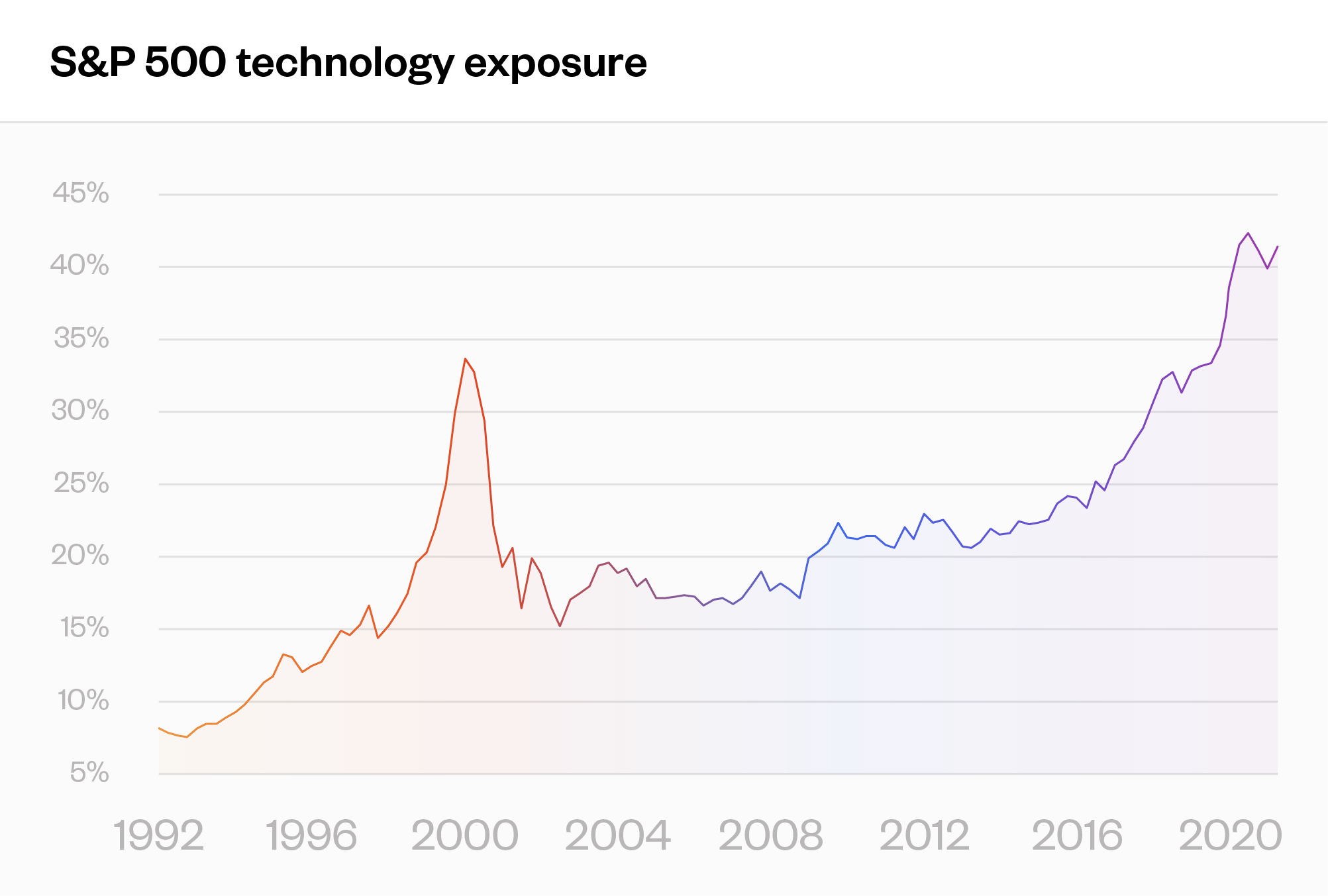

As the market stands today, this is a big problem for diversification, because the largest stocks have much higher capitalization of the rest of the stocks. The top ten stocks in the S&P 500 have 25% of its weight. The technology sector is 40% of the S&P 500. As you can see from this chart, this is a historic high. The only time it came close was in 2000. (And things did not end well that time around.) Without even knowing it you have placed a big bet on technology.

So what if you pick the 500 stocks, and put an equal amount of money in each one. There is another problem that keeps you from being at peak diversification. Some sectors of the economy have more stocks than others. For example, of the 500 stocks in the S&P 500, there are many more industrial companies than there are banks. Which makes sense, because the money center banks are few and large, while many industrial companies are specialized and relatively small.

So if you are cap-weighted, you are over exposure to technology, and if you are literally equally weighted, you are concentrated in industrials and underweight financials. Still not super diversified.

The solution for increasing diversification requires some more thought. You want to construct a portfolio or find an ETF that is spread well across economic sectors, and also across country exposures, and also across what are called styles, such as value versus growth, large companies versus small companies, high dividend versus low dividend, etc.

There are any number of methods for doing this. Three I like, which each has a different approach from the others, are Syntax, which does a bottom up approach looking at all of the exposures company by company; TOBAM, which uses a mathematical, optimization approach; and MSCI, which uses a factor-based approach.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk