Long Term Goals and Market Risk

If your client has fifteen or twenty years to their investment goal, no worries about market ups and downs, right? Here is some background to think about.

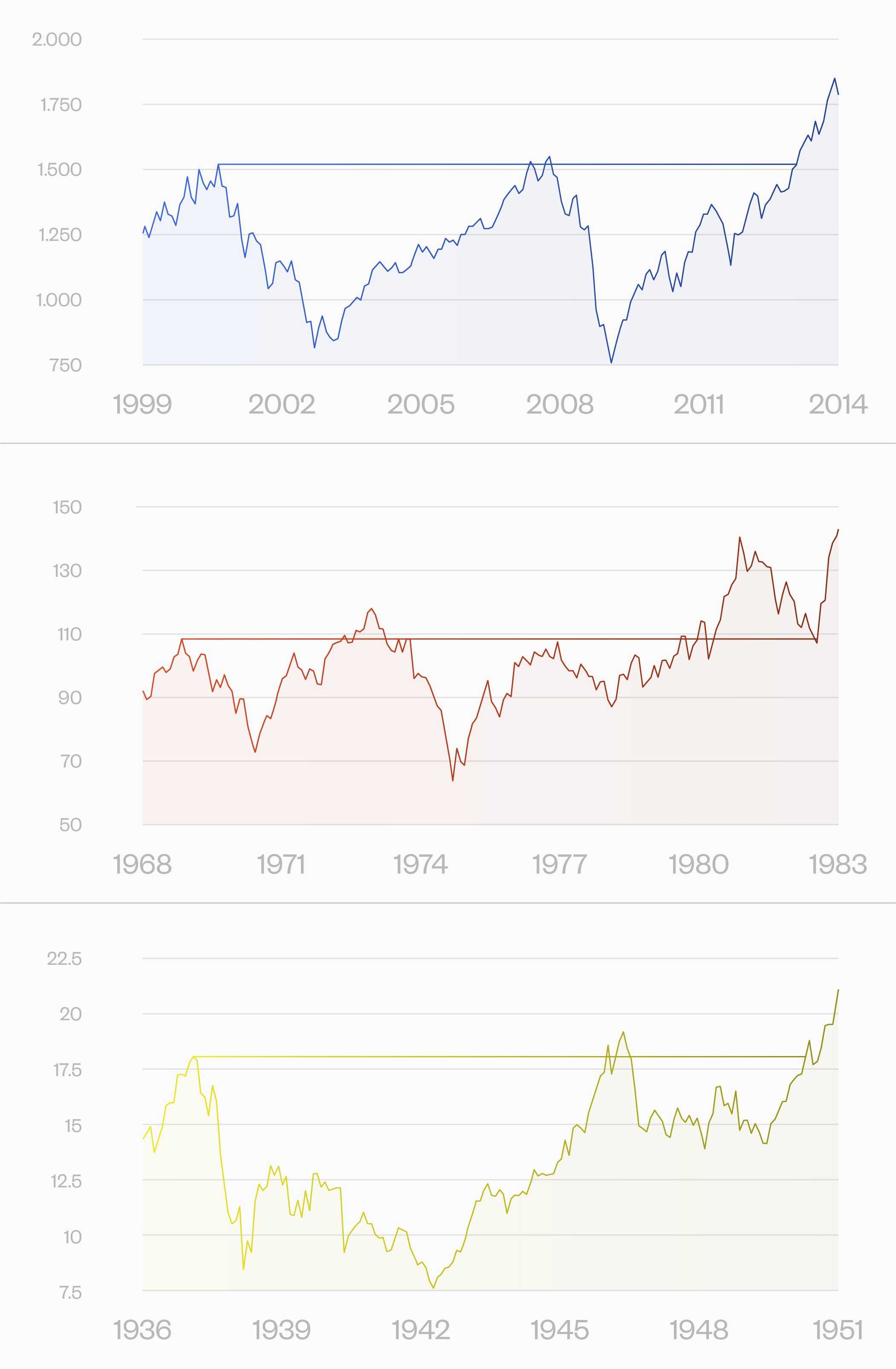

“Lost decade” came into our lexicon from the Japanese market, But we have had lost decades -- and then some — in the equity markets, where it was over ten years, 13 or 14 years, actually, before the market started back up for good from the previous level.

The chart shows these: 2000 to 2013; 1968 to 1983, and 1937 to 1950. I’m not going back to 1929 because that almost wouldn’t be fair.

What is interesting, but not a dependable factoid, is that in each case it was just under twenty years from the end of one to the start of the next. That is, the first ended in 1950 and the next started in 1968; then that one ended in 1983 and the next started in 2000. So no worries, we have until 2030 or so for the next round (just kidding).

Bottom line: Long-term goals don’t make you immune to market risk. If you are looking out 50 or more years, good chance, but if it is ten or twenty, no.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk