As Tesla Goes, so Goes the Market

Tesla is what happens when crypto craziness bleeds into the markets of planet earth.

As Tesla goes, so goes the market. Maybe. There is concern that Tesla is the tail wagging the market dog, but I’m not sure about that. I think Tesla is what happens when crypto craziness bleeds into the markets of planet earth.

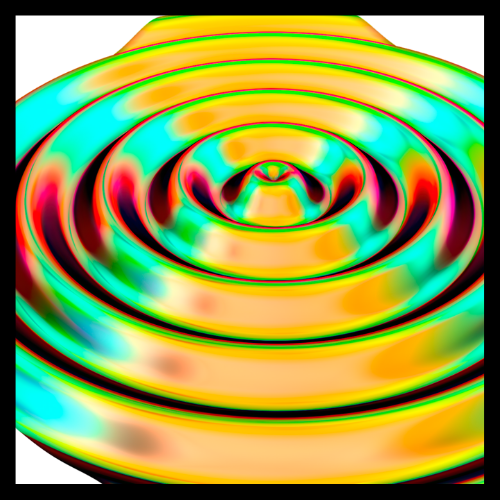

As the chart shows, Tesla is a huge outlier in terms of turnover in both its stock and options. It also has more option volume than any other stock, even many markets sectors. It’s like a market segment unto itself. If a market sector hits the skids — like Internet and TMT did in 2000, or banking in 2007, the market can follow. If Tesla has that sort of weight now in terms of market technicals, will the same thing happen if Tesla starts to drop?

%20(1)-1.png)

The key question to answer to get to this is who is doing all of this trading? Where is the froth coming from; who holds the options?

Whether Main Street (aka retail) or Wall Street, a drop can hurt people’s portfolios and lead them to second guess and start to sell more broadly. If those holding them are levered, all the worse. (But that said, having options does limit the need for forced selling unless they are naked sellers.)

Critically, now we have another group beyond Main Street and Wall Street: Cryptoland. If the people who have a taste for the crypto lottery are also the ones who are fingering their Robinhood account on the iPhones to play the Tesla options, then the link between Tesla and the broader market is not so strong. Because then what we are seeing is not so much an investment in a portfolio as a sideshow, trading as entertainment.

The implication of a drop in Tesla will not lead to a liquidation in the broader market, because this group is not material for the market overall. In fact, a subset of the crypto crowd finds standard investments anathema, tethered as they are to the flawed world of central banks and countries’ currencies.

Source: Robin Wigglesworth has an article on the potential systemic issues from Tesla in a recent Financial Times. (And, by the way, has a great book out on index funds, Trillions.) The chart comes from that article, which in turn is based on data from Goldman Sachs.

P.S. That other, less dramatic outlier is Amazon.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk