Treasury and Credit Risk

The idea of 60/40 is to combine risky equities and safe bonds. The problem: Now it is risky equities and risky bonds.

A common starting point for asset allocation is 60/40; 60% in stocks, 40% in bonds. Nothing magical about it, but the idea is to keep some assets safe. And bonds are safe, right? Currently, no. Let’s look at things one at a time, Treasuries, and then corporates.

One at a time with just these two types of bonds. Because bonds like munis have the same issues as corporates. And agency mortgage-backed securities are like Treasuries with a twist or two.

Treasury bonds

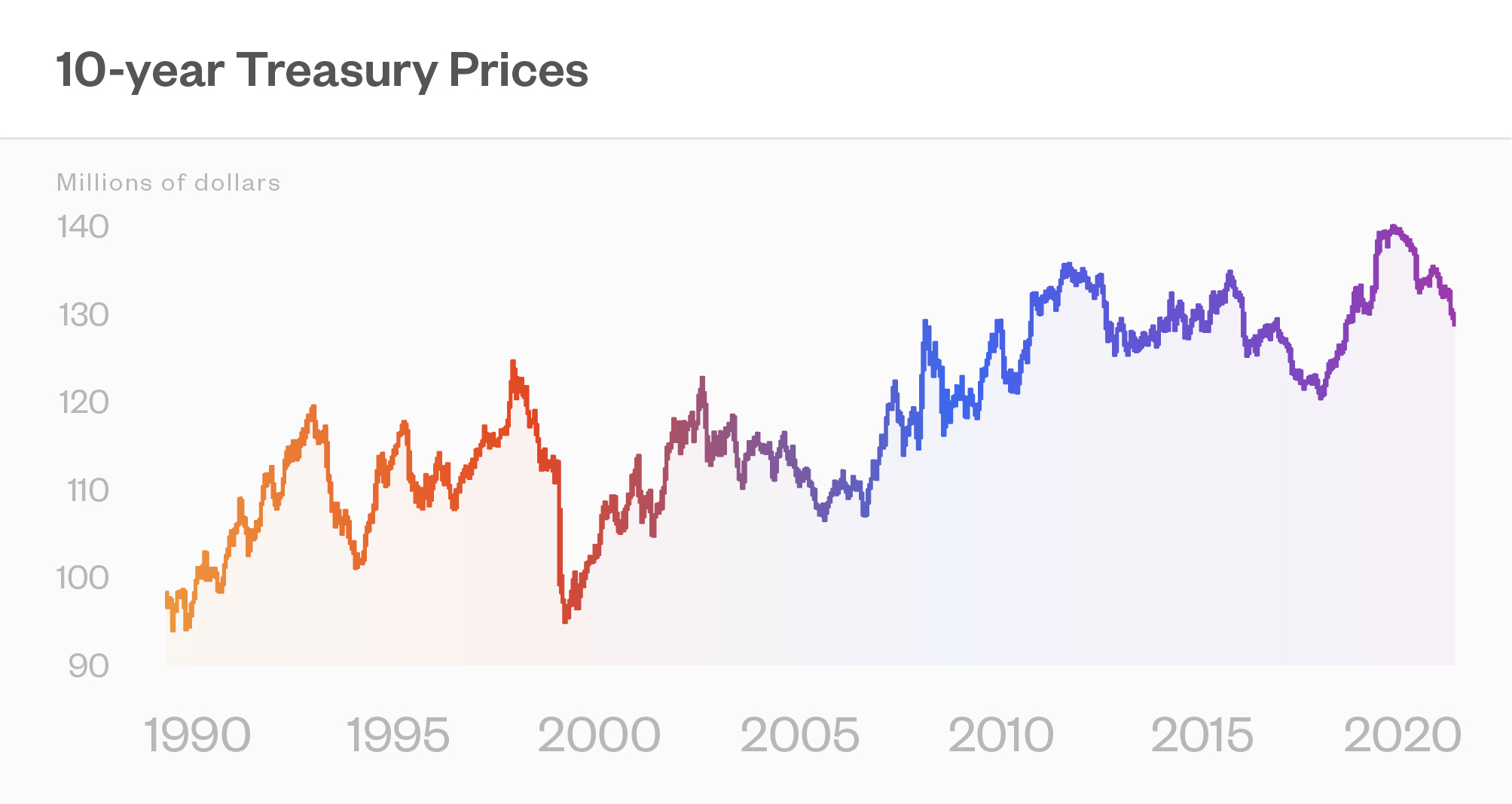

The chart below shows how much Treasury prices can vary. There are price moves of 20% or more. And this is not going back to the 1980s when things were really crazy. Of course, back then we had problems with inflation. ![]()

Treasuries have zero risk if you hold to maturity. For sure you will get your coupons and get your principal back. And they are low risk if you match the duration of the bond to your liabilities, which is something an insurance company might do, but rarely will an individual.

Using history as a guide, if you worry about marking your portfolio to market, if you are going to roll your bond positions, if you’re forced to sell them before maturity, you might take a hit.And I would not use history as a guide — at least not history of the past thirty years. With the prospect of inflation and Fed action leading to a rate rise, with so much open field given the low level of rates today, risk is higher now.

Speaking of lower rates, we might think that Treasury rates in the two and three percent range is the way the world is supposed to be. Well, when I was at Morgan Stanley in the 1980's, we thought 8% rates was the way the world was supposed to be. If you have a twenty to forty year horizon, there is plenty of room for the world to change.

And how we got to these low rates should give the 60/40 investor pause. Since the mid-1980s, rates have been on a non-stop downward trajectory, so bonds have been a surefire investment. I know of some hedge funds that have made their money and amassed huge AUM by basically being long levered Treasuries. Which is to say that the past 40 years have been nirvana: Yes, equities rising, as well they should in the long run, but with bonds following suit.

Corporate bonds

The focus is corporates, but what I am saying here can extend to other bonds where there is a risk of default. The point is that besides interest rate risk, there is notable credit risk.

Credit risk is difficult to gauge based on what is happening day to day. But it is an area of growing concern.If there is a credit event, there is a lot of room for credit investments to run off the tracks.

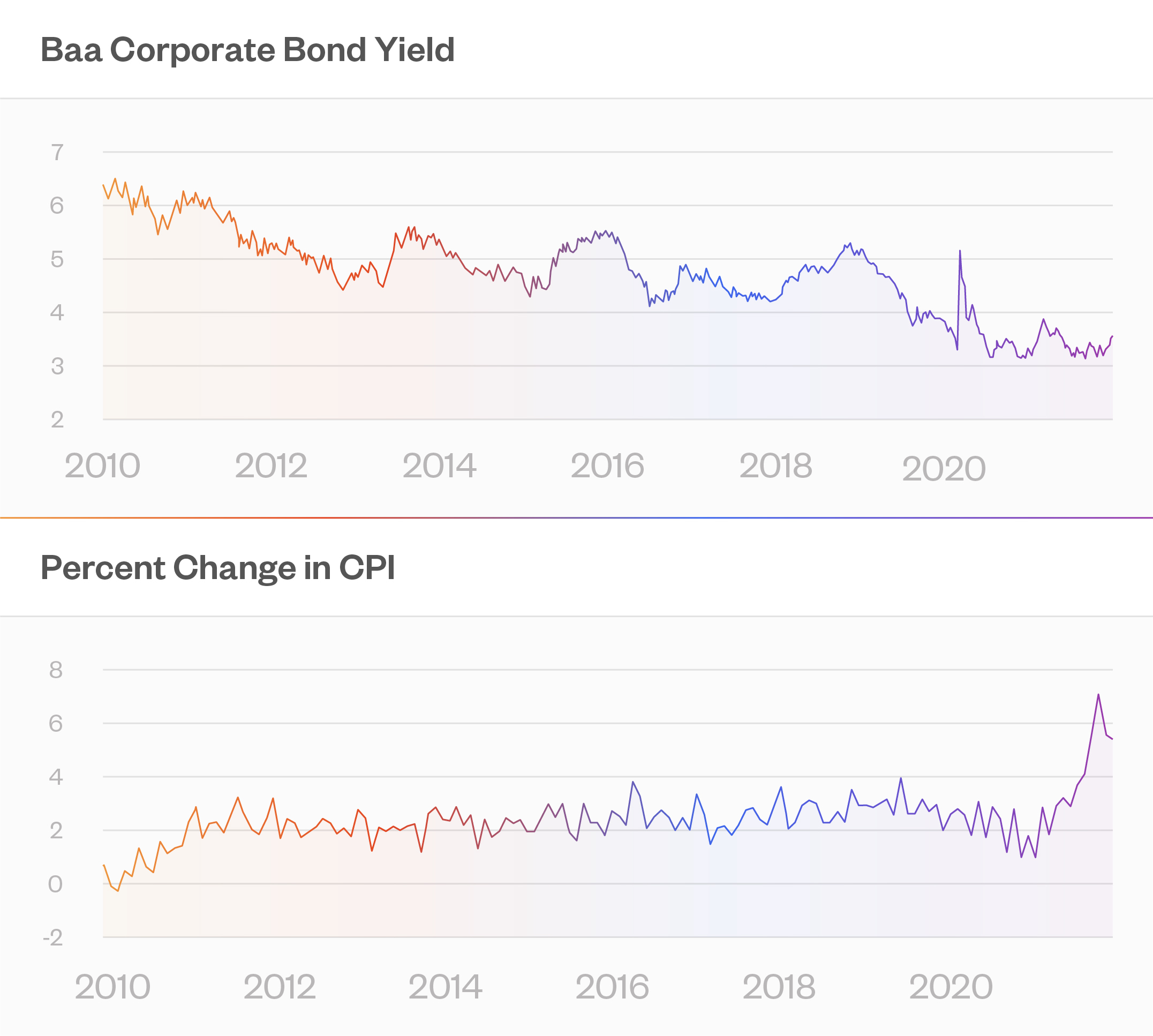

When you take inflation into account, the rates for corporate bonds are at an all-time low. Even without an inflation adjustment, they are near the all-time low. You can see this in the two charts accompanying this post. First look at nominal bond yields in the top panel, then move them down by some measure of inflation from the bottom panel.

Even if the world returns to rational absent an event, corporate rates especially in the high yield bond market are going to rise substantially.“Substantially” can mean huge spreads over Treasuries. During large credit dislocations we have seen high yield spreads widen into double digits. Which of course means big losses for the bond holders. It also means a markdown for credit exposure elsewhere, but is most manifest in the high yield bond market because that is where you can get a mark-to-market for credit risks.

But you don’t even get a good read on risk there. The volatility in the bond market does not do a great job of manifesting risk because credit risk is of the “make a little…make a little…lose a lot” sort. Most of the time things look fine. Not much happens, volatility is low.

By the way, the total size of credit risk exposure is not fully evident because some of it resides in private equity. Private equity has seen a reduction of returns due to more money competing for opportunities, and so has turned more into private equity/credit. Often with the credit exposure opaque.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Recommended Articles

JANUARY 6, 2022

7 Things Bitcoin Fans Say—and Why This Risk Expert Says They’re Wrong

Read More

JANUARY 6, 2022

7 Things Bitcoin Fans Say—and Why This Risk Expert Says They’re Wrong

Read More

JANUARY 6, 2022

7 Things Bitcoin Fans Say—and Why This Risk Expert Says They’re Wrong

Read More

© 2022 Fabric Risk