Are we in for a Lost Decade?

So, as we look at the prospects for market declines, we should ask if we are set up to add 2022 to the list as the start of another lost decade.

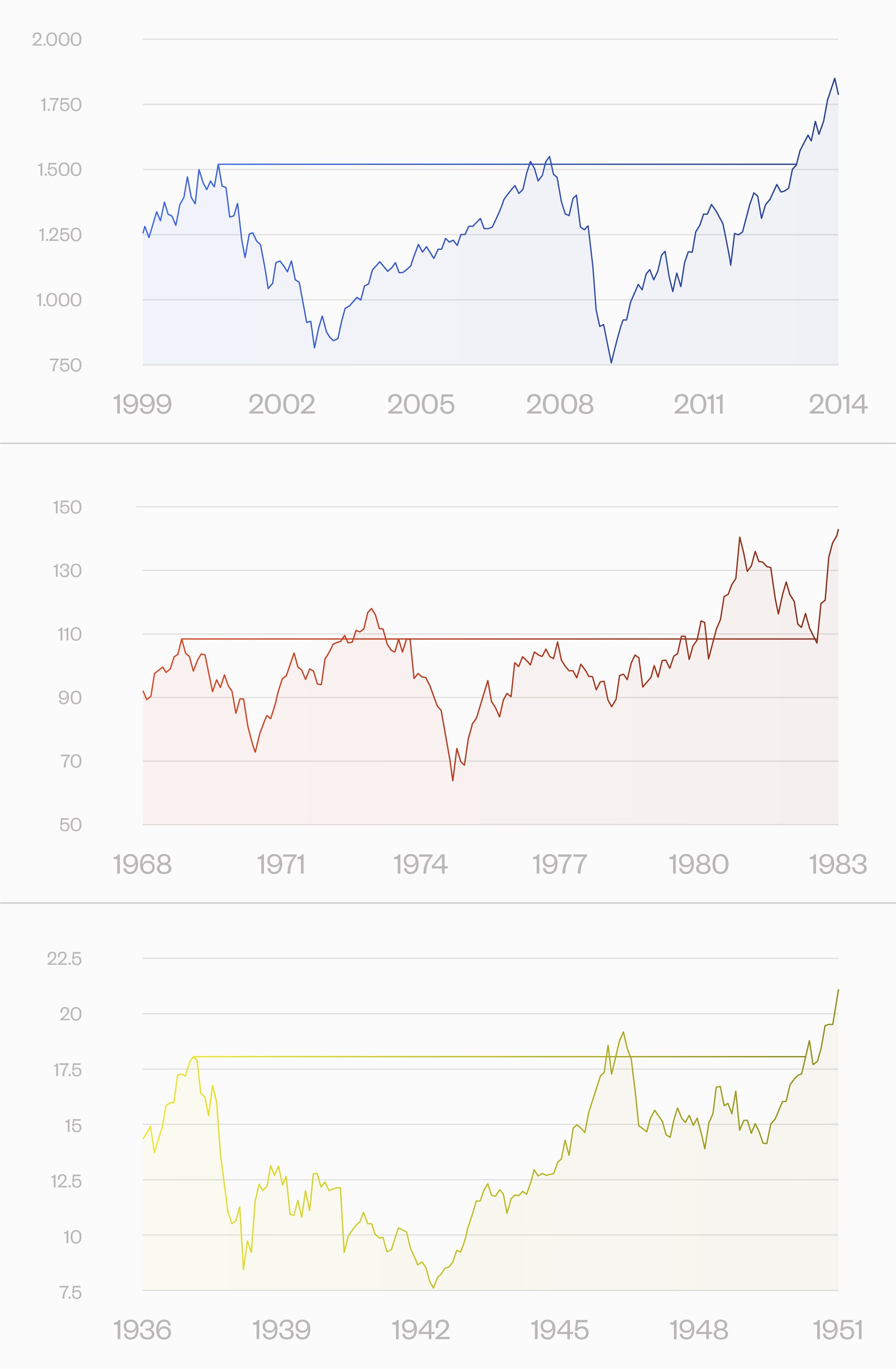

The term Lost Decade came into the lexicon after Japan’s market performance extending from its 1990 market debacle, when the Nikkei dropped over fifty percent, and only moved up for good from that level sixteen years later. So more than a lost decade, it turns out. The U.S. has had lost decades as well, from 1937 to 1950, 1968 to 1983, and 2000 to 2013.

In each case, an investor standing at the end of the period could look back to see that the level of the S&P 500 was the same as at the start of the period. That is to say, in each of these periods the S&P ended up being flat for well over a decade.

Looking at the prospects for market declines, will 2022 be the start of a decade lost to market appreciation. Consider the market vulnerability, and the dominos that are readied for a cascade.

A lost decade is the result of a sequence of events. Sometimes the weakened market from the first sets up the next. Sometimes it is just bad luck that one thing follows the other. But clearly, if the market is vulnerable, there is more chance. Because once one event takes the market down, it is unlikely it will strengthen against further crises. And if there are risks coming from many directions, there are more dominos that might fall.

I look at market vulnerability through the lens of four factors: leverage, liquidity, concentration, ad valuation. All of these have been in the highly vulnerable range for the past several years, even extending back to pre-pandemic. And despite the recent market weakness, they remain concerning. Leverage and market concentration are at the early 2000's level. Price to earnings and price to sales have dropped with the recent downturn, but still remain far above their usual level. So as events shake the market, there are limited shock absorbers to dampen the effect.

As for dominos, usually, there are one or two areas of material concern. Now there are a multitude. Overheating is part of the tech sector, although we are seeing a slow-leak correction. We have the structural risk from inflation. And that might turn into stagflation with the looming prospect of recession. Rates are rising for the first time in four decades. Credit is a flashback to 2008 because of overextension because of such cheap funding. There is a prospect for a shift in the economic sphere as well, with a turnaround in the march toward globalization. And, moving on to existential concerns: climate change.

Many of these risks are all the more troubling because they are outside of our experience. Credit cycles and recessions may be commonplace, but we have not had inflation since the 1970s. We haven’t seen rising rates since the early 1980s. Globalization has been a one way street. And climate change has no market precedent.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk