Has China peaked? Is it starting to roll down the other side of the hill?

Here is a brief look at China’s looming financial crisis, reduced marginal productivity, and reverse demographic tidal wave.

Has China peaked? Is it starting to roll down the other side of the hill?

We’ve seen this before. In the 1980’s Japan was emerging as the next economic power. Japan was on the path to dominating industries one by one, the most striking being the automotive industry. But they were crippled in turn by the bursting of a real estate bubble and the Lost Decade, (which turned out to be much more than a decade), diminishing returns for capital investment, and demographic stagnation.

So a brief look at China’s looming financial crisis reduced marginal productivity, and reverse demographic tidal wave.

Real estate and financial weakness.

Looking for slow motion train wreck sorts of financial crises? Don’t dwell on the stock market. Try overextended and leveraged housing. The reasons: They are a large portion of an individual's wealth. They have to make payments. They are essential for day to day living. They are illiquid. The leverage hits closer to the heart of the financial system, not prime brokers and repo desks, but mortgage lenders. It takes time for supply to be built up if it is too little, and to be absorbed if there is too much. There is a lag between demand and supply, so you can end up like a student pilot oversteering the plane one way and then the other.

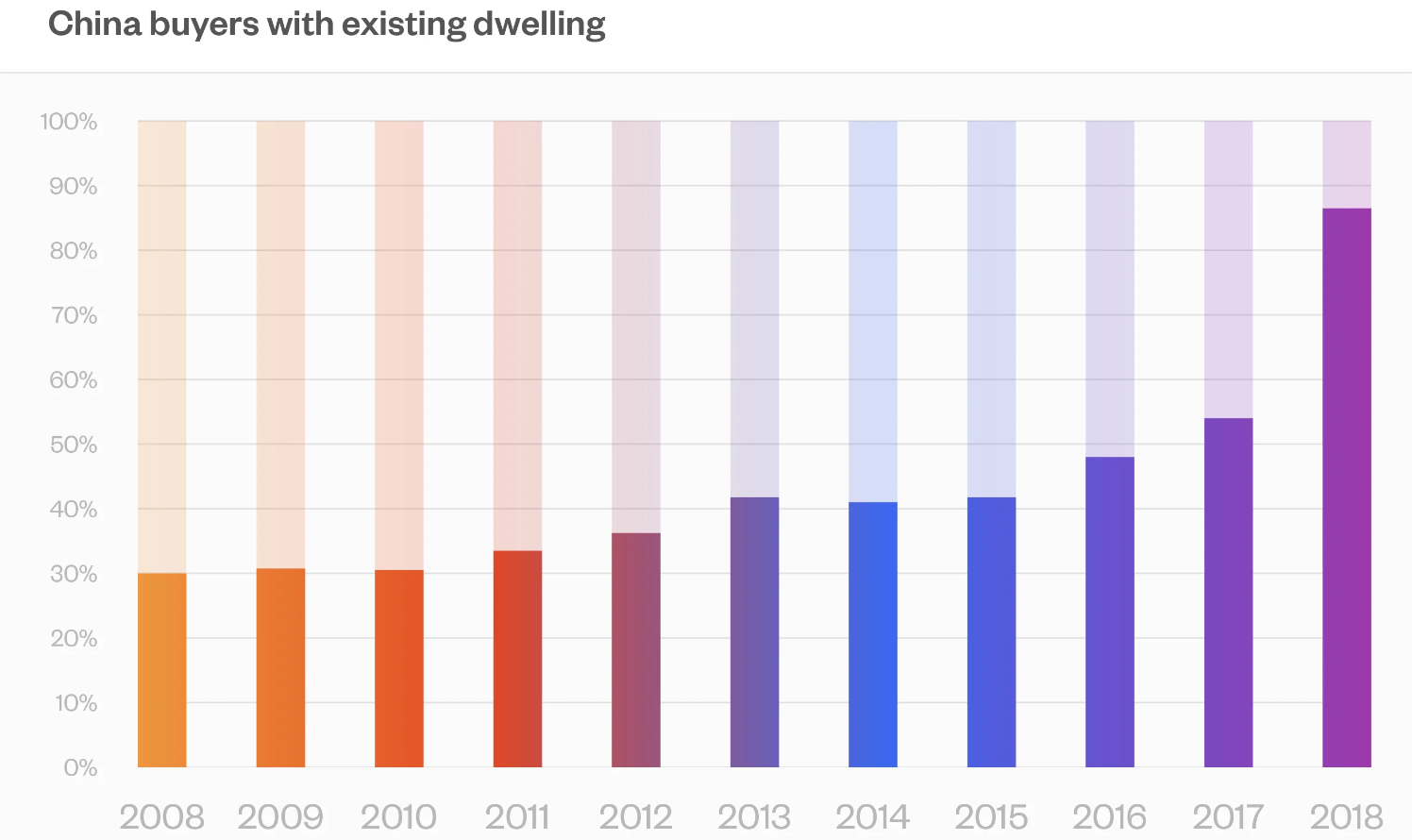

Here is one of any number of ominous charts in this regard. This one is the number of home buyers who already own a home. A decade ago it was 35% — already pretty high — but even three years ago it was a screaming 87%.

You really only need one home, so why do you have two or more. Well, in China it is not a vacation home, it is speculative. And when you are forced to sell, the only people buying are those who currently have zero homes, have the savings, and are not spooked by the real estate bubble bursting.

Marginal productivity

Real estate has been the center of China’s capital investment and production, so it bleeds from the financial sector to the real economy. Take it away, and the roots of China’s economic engine are showing the first signs of rust. One component to this is the sputtering movement of production up the chain from labor intensive production. Another is the realization by the U.S. of the risk in putting China at the well spring of the supply chain and moving away from dependence. And there is the door being shut on the easy money approach to economic development, namely the theft of intellectual property. For all the state support, they are far behind in internal efforts toward industrial research and development. Take batteries, for example. Largely through being asleep at the wheel, the U.S. has ceded all manner of battery development and supply to China. But now the U.S. leads in new technologies which will lead to batteries that are substantially more powerful and long-lasting than existing ones, and that do not depend on raw materials that are increasingly difficult to obtain.

Demographics

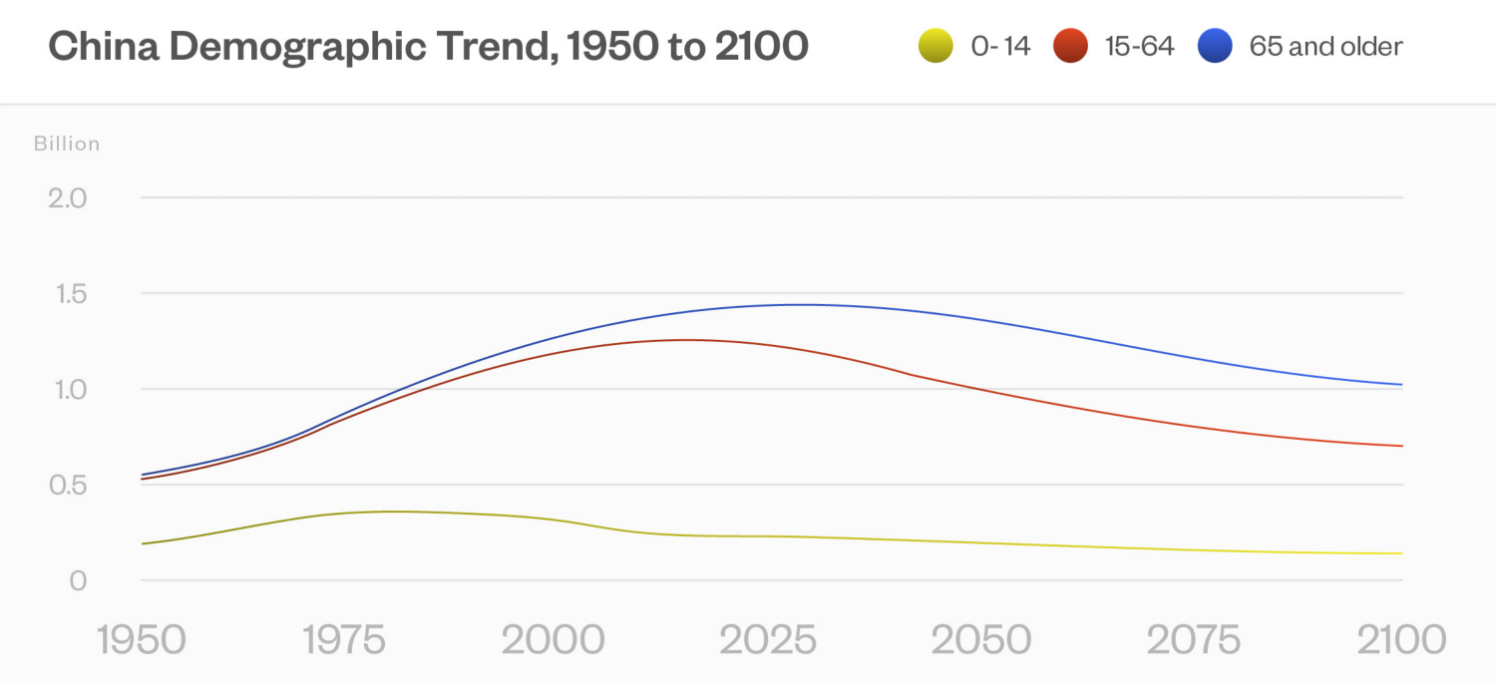

For most risks, maybe they will be realized maybe not. Others are sure things, only the impact is uncertain. You’d think things very far out are the most hazy and uncertain. But not so for demographics. For example, if we take cross-border population flows out of the picture, we know today the working class cohort 25 years from now.

China is a case study for risk coming from demographics. The accompanying chart shows the troubling trend. Population growth continues a decades-long drop, and an actual population decline is just around the corner.

You might think trying to get a read on trends far into the future is so iffy as to be useless, but not so. Trends in the birth rate change course very slowly.

The risk part is not will it happen, but what will it do. It’s a question for many countries. For China, the issue is more acute than for others, because the sheer size of its workforce and consumer base has been a more central part of its economic growth. China certainly sees it as a threat, and there are proposals to stem this tide flying out from the policymakers. But if history is a guide, it is like buttressing against a tidal wave.

Source Graph 1: NBER Working Paper No. 27697

Source Graph 2: United Nations

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk

.png)