Risk from China's Real Estate

If things go badly, the course of the events in China is not only to see cascades down for Evergrande, it is contagion to other markets and to other developers.

As a risk manager, I am used to pointing out risks and scenarios that end up not being realized. I know how it feels to see risks and vulnerabilities remain unresolved -- for years. At this point, however, with China we might see the tipping over the edge, and a yawning gap on the way down.

Here is a chart of property prices in various versus household income. The chart is no secret, and its importance as a metric is likewise well known.

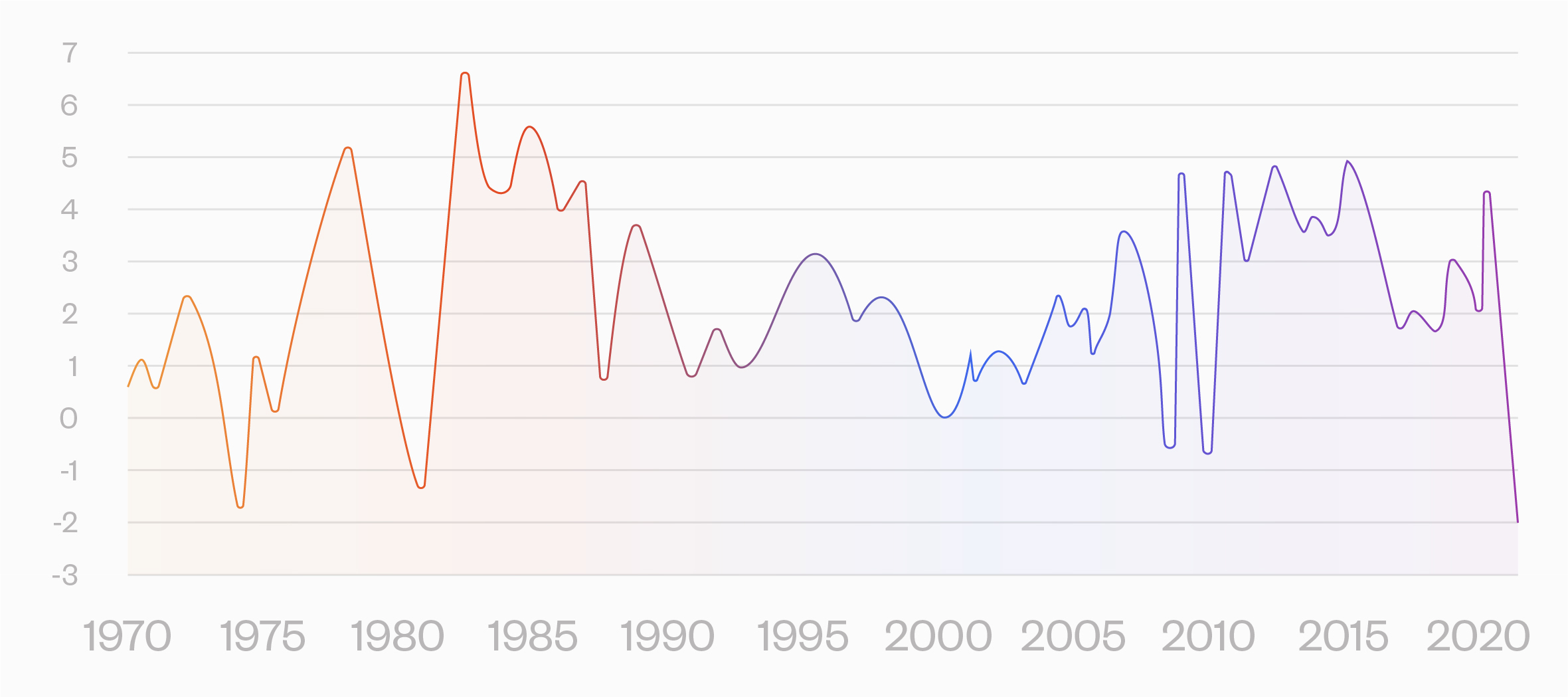

Bad enough, but if we adjust earnings for inflation to look at real earnings, we are in uncharted territory. This chart shows smoothed inflation-adjusted earnings yield.

It is below the 2000 and 2008 levels, even below the worst levels during the 1970's, when there was a huge inflation tailwind.

The counterargument is that with low rates, discounted future earnings count for more. But as I have argued elsewhere, this Finance 101 approach to valuation works for a class assignment, but not for serious valuation. The risk premium on earnings looking out 20 years is going to dominate the effects of an interest rate that is a percent or so lower than the recent past.

Thanks to Ned Davis for highlighting the real earnings yield.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk