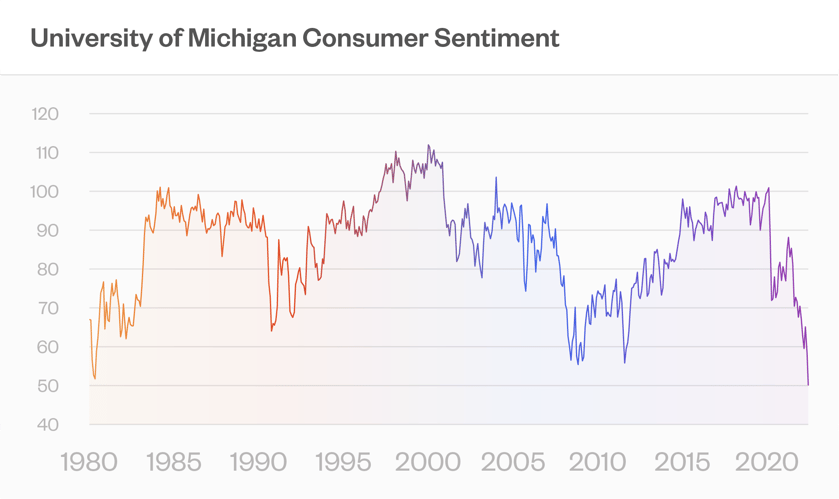

Consumer Confidence

Beyond the numbers is that bad news reaching into our consciousness? Are we being more glass-half-full, or glass-half-empty?

A 60/40 portfolio — one that buffers the volatility of equities with the stability of bonds — has not done too well lately. So we are hearing “The death of 60/40". No, what is going on is more, like “Now you know what 60/40 really looks like”.

As the figure shows, year to date a 60/40 portfolio has done the worse in over sixty years. The S&P 500 is down 20% year to date, the worst since the 1970s. The Barclays Ag is down 16%, the worst first-half performance since the index started in the early 1980s. Put the two together, and this is what you get.

And, to make matters worse, the historically bad results are broad based; not just equities and bonds, but both high cap and low cap equities, Treasuries and corporates. (Actually, value has not fared so badly, at least when compared to growth. No surprise, given the notably bad performance of the Nasdaq.)

Equities, of course, are risky. Their risk is mostly tied to the discounting of future earnings. Bonds are also risky. Their risk is tied to rates and credit. There is no law that prohibits both earnings to be revalued and rates to rise at the same time.

I have written recently about the risk from holding bonds and from 60/40: Interest Rates and the Fed and Forward-Looking from Rising Rates. In the past six months we have seen the risk turn into reality. There are reasonable scenarios where 10-year Treasuries can drop 10% or even 20%. There are reasonable scenarios where credit spreads can go up 300 or 400 basis points. Actually, even 700 or 800 basis points.

So, “The death of 60/40"? 60/40 does what it is supposed to do. It just isn’t doing what you want it to do. What you want it to do is not only dampen risk, but give some sort of buffer focused on the downside, be sure to keep some powder dry. To do that, you can (1) Put some of your portfolio into cash. Not into bonds. (2) Use a structured product to create an income stream that is not rate-sensitive. Or, (3) Peg bonds to cashflow needs. For example, create a duration-matching portfolio. Then the mark to market swings won’t matter relative to liabilities.

With a 60/40 you generally dial down your portfolio’s volaltity, because bonds almost always are less volatile than stocks. And you are getting is some diversification when you move out of equities into rates and credit. Note I am saying some; of course they are correlated, but to make matters a bit more difficult, the correlation between rates and stocks is sometimes negative, sometimes positive, sometimes hardly there at all.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk