Hedge Fund Performance

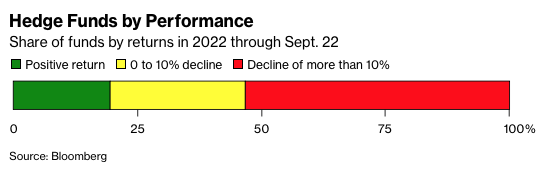

When there is high leverage, some fund is going to do spectacularly, another is going to flounder or fail.

Hedge performance is a spectator sport. The stupendous performance of the top hedged funds, the dismal performance of the laggards. How hedge funds are doing this year; what they’ve done over past years. You and I are reading the same stuff, and I don’t know about you, but I wonder why someone is spending their journalistic brain cells reporting on this hedge fund or that one making 100%+ returns. Or reports of another one failing.

When there is high leverage, some fund is going to do spectacularly, another is going to flounder or fail. Look at the statistics, and it is clear that chasing the most successful ones is a crap shoot.

It is paradoxical, but some hedge funds that have inception-to-date returns that knock it out of the park and that have huge AUM have in total been money losers for their clients. Why? Because during their early years of great returns they had low AUM. Then the money poured in, and at the time AUM was highest they went south.

The poster child for this is Julian Robertson and his Tiger Fund. Sure, someone who bought into Tiger at inception would have done great, even after it crashed and burned. But for every dollar put in at inception or thereabouts there were hundreds put in down the road. Multiply AUM by returns over time, and you’ll see what I mean. I wrote about ARKK in this regard; [here] but maybe there is no surprise there. Anyway, check out others; and for any hedge fund that touts its long term returns, put that side to side with AUM and see what they really did for their clients. Versus themselves. (I won’t even get into the blow-ups like LTCM, or Three Arrows Capital. That almost isn’t fair.)

That's what you might get from return chasing.

This is the scenic path to the issue of custom indexes. It starts with hedge funds because one of the first places custom indexes were used was in hedge fund replication. If you like to use hedge fund strategies — if you have the nerve to lever and short, which I don’t recommend for individuals — you can get 90% of the way to what many hedge funds are doing while avoiding the fees by looking at their factor exposure and creating a custom index that matches them. There is a small industry that helps do this. (Side benefits: You know what you are holding, and you have the advantage of being able to adjust or get out quickly. Not only not having gates, but a big fund can take days, even weeks, to work out of trades. As an individual you can do it with a keystroke or two.)

This works for ETFs as well, and is a lot more sure fire, because you 100% know the ETF positions. For example, we do this at Fabric using the MSCI factor model to break up any portfolio into its factor exposures, and from there you can reconstitute it, or, more to the point, modify it for your specific objectives. Say, create a custom target that is underweight oil and gas because you are in the energy business and have exposure already. Or turbocharge climate, either for social reasons or because you think there is risk there that is going unrecognized.

Customization is critical for individuals, because each individual has different goals, different preferences in terms of investment (like the climate example I mentioned). And whatever they have now is more likely than not to be off kilter for their objectives down the road. It is interesting that its roots can be traced back to trying to out-game the hedge fund industry.

Fabric provides risk aware portfolio design to safeguard your client's future. Customized to meet each client's goals.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Fabric provides risk aware portfolio design to safeguard your client's future. Customized to meet each client's goals.

© 2022 Fabric Risk