Household Debt

Households are levered, concentrated, and not very liquid.

Leverage coupled with low liquidity is a volatile combination. If things go downhill, you have to sell, and when you try to sell you end up chasing the market. The result is a downward cascade.

And it gets worse because as liquidity dries up in the markets where you have high concentration, you need to turn to other markets, so there is contagion. This can be pretty perverse — sometimes markets that are liquid, solid, and just sitting around minding their own business are the ones that get hit. Because when you can’t sell what you want to sell, you sell what you can sell. And that is the stuff that is the most liquid.

When this leverage-liquidity dynamic plays out you see violent drops in prices and contagion to other markets that seem to have no relationship — actually, the operational relationship is that investors hold both of them in size.

The prominent domain for leverage is hedge funds, which is why they can generally be well behaved, but simply disappear in times of stress. But when it is hedge funds behind the leverage-liquidity dynamic, it is more or less a flash in the pan because in the grand scheme of things they are not so big relative to the market. It is like someone once said to me when I had food poisoning, “it’s violent but benign”.

What is not benign is when a giant swath of the market gets caught up in the is dynamic. Want a really big swath? Try households. Aka retail investors. It seems people don’t care a lot about what goes on with retail investing, at least as measured by the number of views of my LinkedIn posts when households are the topic. Households, climate, and demographics are not very sexy. But they are like a supertanker changing course. No flash in the pan if they get involved.

Which is all a large preamble to the point, (my journalist spouse would say “you’re burying the lede”): Households are levered, concentrated, and not very liquid. Here are the charts to make that point.

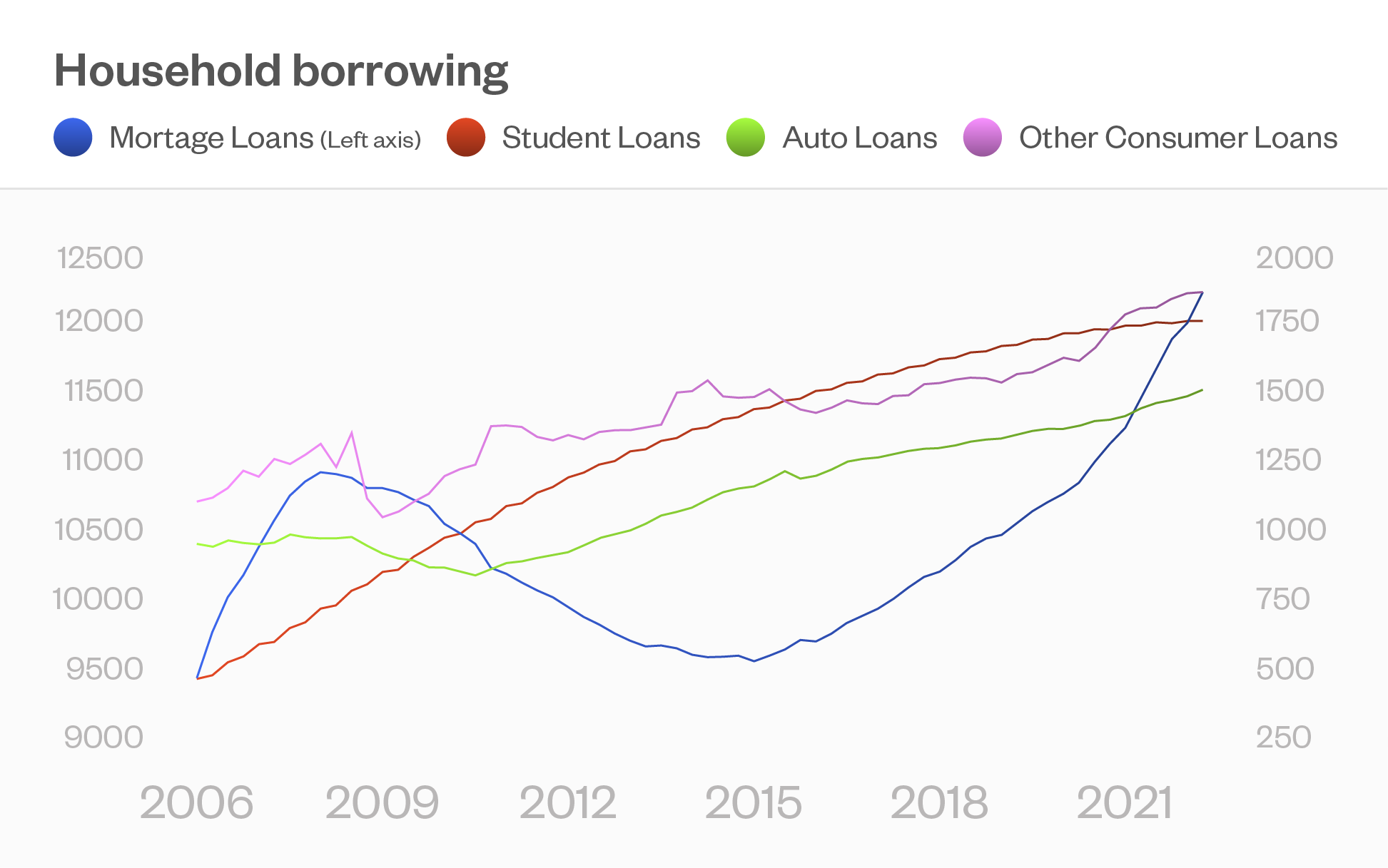

Leverage. The leverage is not in the market; it is in debt. Debt has been rising like there is no tomorrow. And rising as costs are rising as well. This doesn’t lead directly to forced liquidations in the market. But it has the same effect.

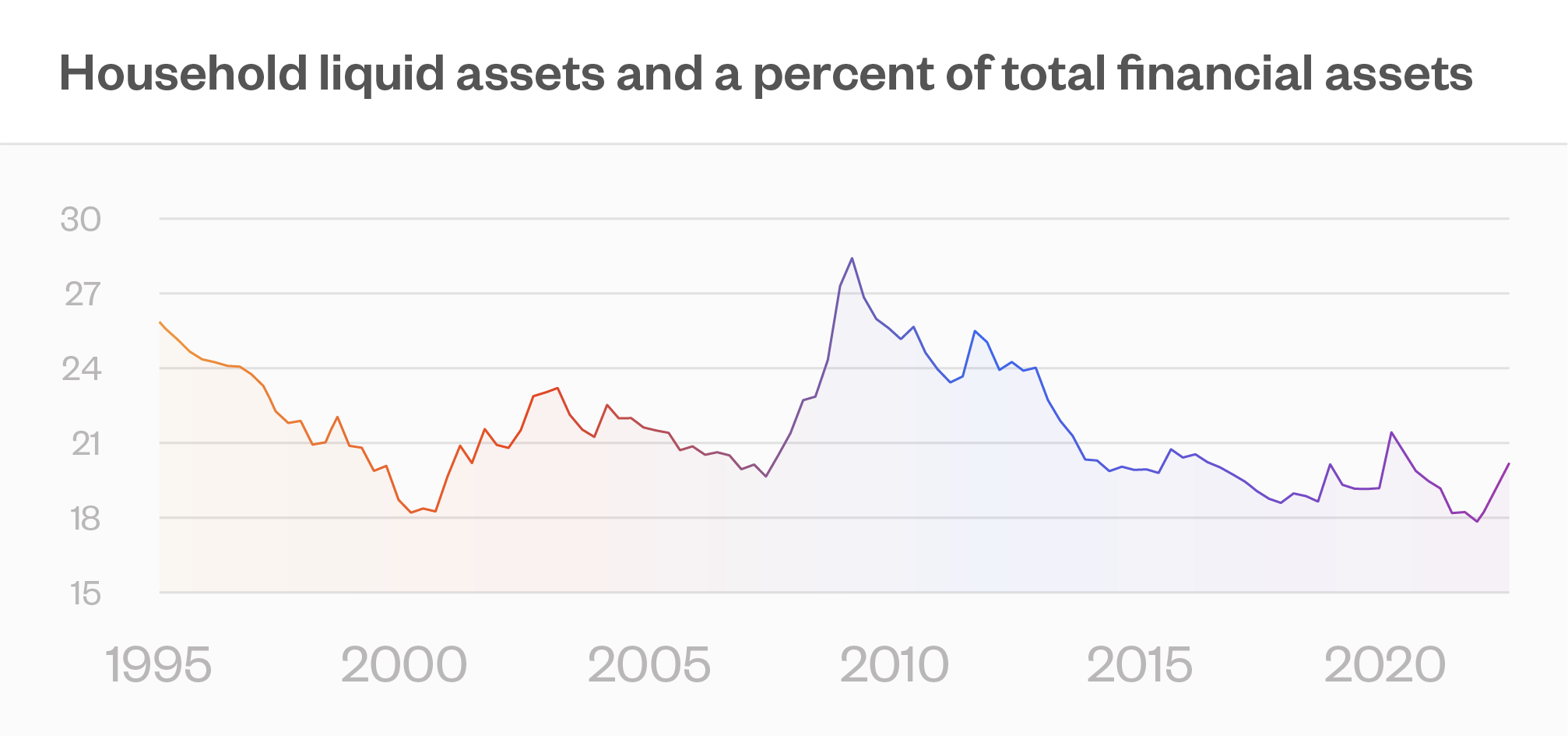

Liquidity. The percentage of financial assets that are liquid is near the lowest level in the last 25 years. With a little pop up over the past few months. Tellingly, the other dips were in the run up to 2000 and to 2007.

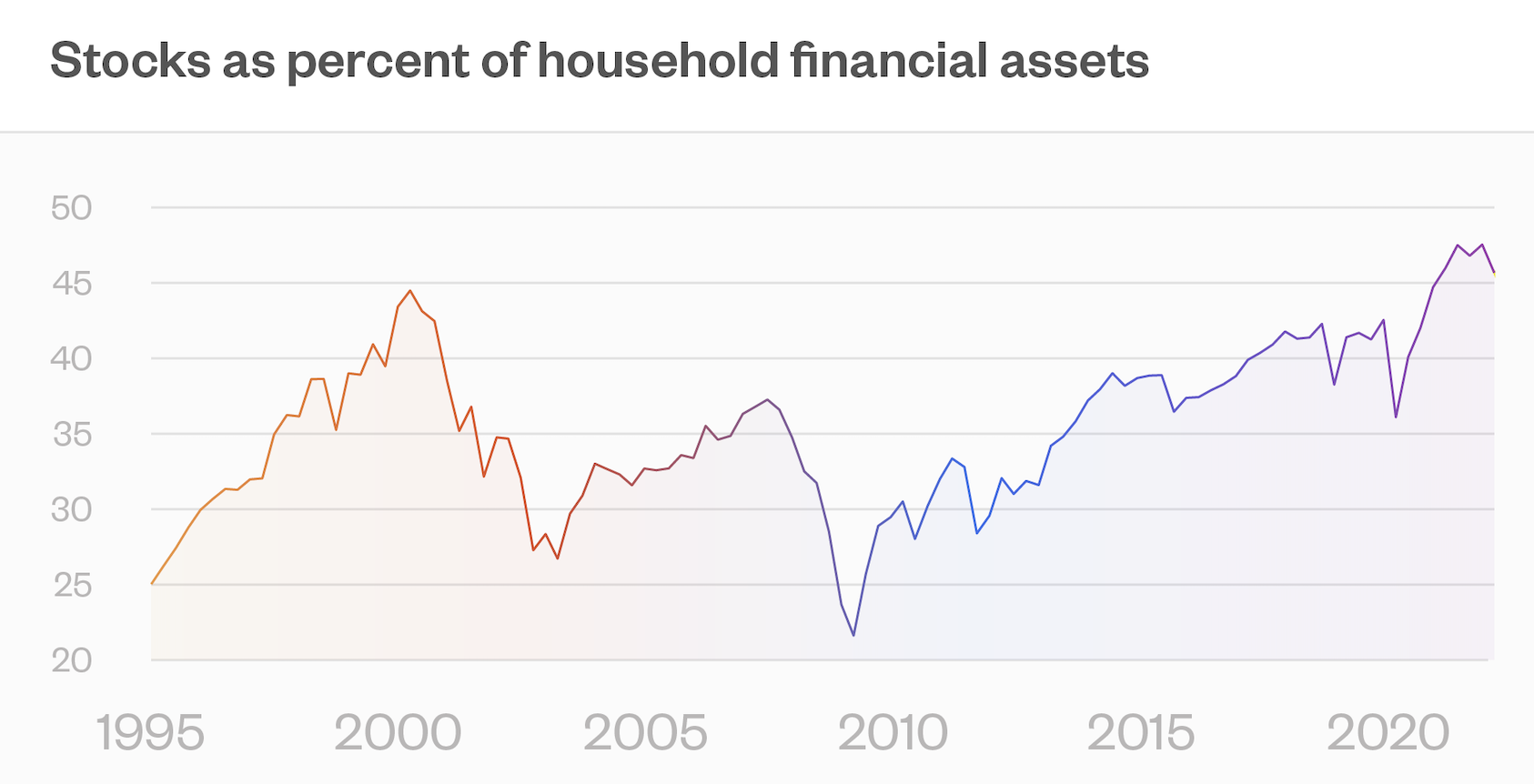

Concentration. The percentage of household liquid assets in equities is at an all-time high. This has numbers ending a month ago, so probably on the way down as the market drops, but still at an all-time high.

When households sell equities, it will be a slow motion train wreck, because unlike a hedge fund facing a margin call, households don’t get a margin call. They see their high debt, see higher costs, see lower asset prices, and start to adjust gradually, with different households reacting at different levels of market stress.

But the dynamic is the same as for hedge funds: A cascade and contagion.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

I have held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California.

We're passionate about putting leading investment technology in the hands of financial advisors.

Access a better way to understand and work with risk.

© 2022 Fabric Risk