Short Interest

The market has headed up since June, yet I see bad news on many fronts. Maybe I have it wrong. Or, maybe there are market technicals that are dominating the fundamentals. More likely the latter.

Is the rally real? Is there risk a sudden drop?

The market has headed up since June, yet I see bad news on many fronts. Maybe I have it wrong. Or, maybe there are market technicals that are dominating the fundamentals. More likely the latter.

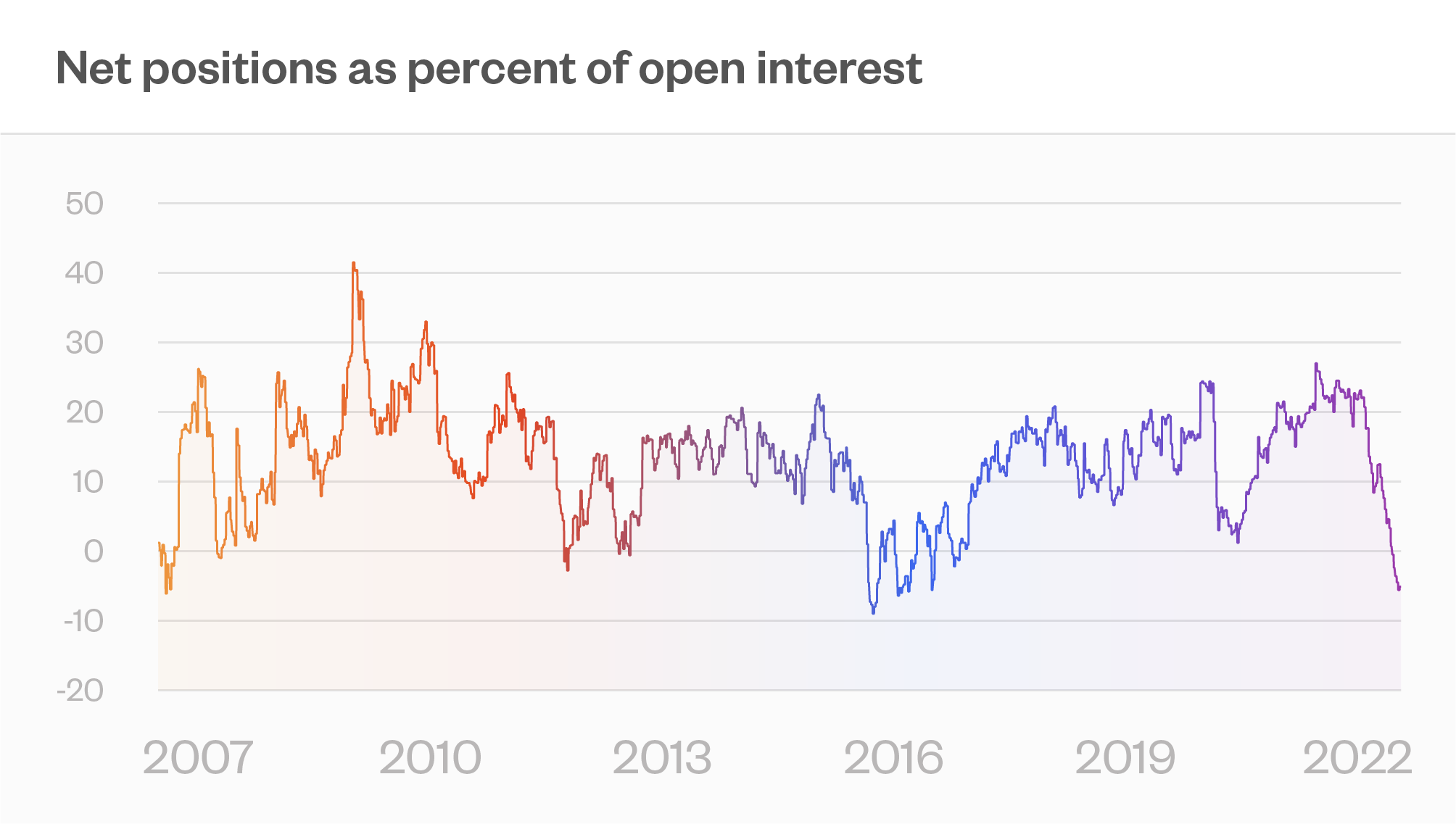

Case in point: As that accompanying chart shows, net positions as a percent of open interest is sitting near its 15-year low. That is, a lot of people are short — like, hedge funds. So what we might be seeing is the slow motion cycle of a short covering rally. Not panicked, but based on maintaining a reasonable level of risk. Things go up, and to keep risk under control, the offending positions are cut. Which means price go up even more.

The meme stock status and the rise and fall of Bed Bath & Beyond might end up being a dramatization for the market as a whole. The Reddit meme stock mob drove the explosive rally in BBBY, with the large short base as a lubricant. And possibly coordinating to execute a pump and dump, but at some point we’ll let the SEC decide on that — here.

There is more buttressing this view. Traders at Goldman, Morgan Stanley, and JP Morgan are all seeing hedge fund clients selling out of long-term shorts. Meanwhile, the usual liquidity suppliers are standing on the sidelines.

And the selling is multiplied in its market effect, as a recent post (and paper based on the post) by JP Bouchaud explains. (See Post)

In terms of fundamentals, there are always two sides of the coin, and for everything that I point out from a glass-half-empty perspective, there is someone else who sees things glass-half-full. So I demur from prognosticating, taking the safe road of pointing out higher risk — which means one should reduce leverage or net beta exposure.

Just to repeat some things I have written about lately.

Consumer confidence is at an all-time low.

Leverage is near an all-time high.

Households are out over their skis in terms of their concentration in equities, near an all-time high.

There is major concentration is stocks as well. Despite the recent downturn, over 25% of the market capitalization of the S&P 500 is in the ten largest stocks.

The Index of Leading Economic Indicators — both The Conference Board and the OECD — have just dipped into recession territory.

House affordability is near an all-time low.

And overarching all of this, we have inflation and a yield curve that is signaling recession, putting the Fed is between a rock and a hard place, where increasing rates or dropping rates — focusing on the economy or on inflation — exacerbates the other.

When the short covering is done, we are back to fundamentals, whichever way that wind blows.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk