Interest Rates and the Fed

JP Morgan is expecting a rate hike in each of the next nine Fed meetings. Goldman is forecasting seven this year. This can be more significant than anything happening with the stock market.

First of all, it means our “safe” bond investments are actually risky. Don’t be surprised by a scenario where the price of a 10-year Treasury is down 20% or more. Second, it means there is one more trigger for P/E ratios to move back down to earth — which of course means stock prices dropping. And third, it might mean our generation-long bull market for Treasuries is at a close.

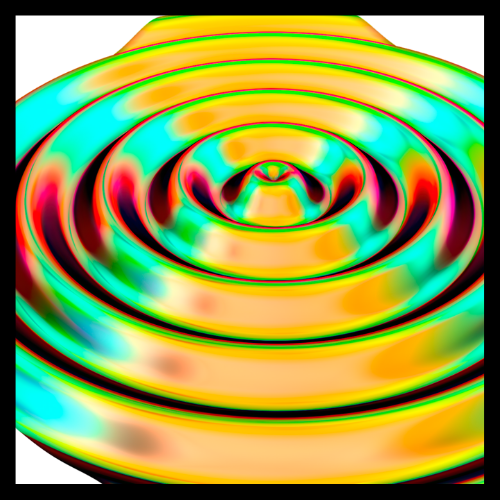

As the chart shows, Treasuries rates have been in a secular decline since the mid-1980s. If you were long TBonds, for the last 40 years or better yet, long and levered TBonds, you enjoyed pretty much non-stop profits. And I know some funds that made their reputation simply by doing that — plus doing some other stuff on the side that amounted, relatively speaking, to noise.

Maybe the bull market should be in quotes. Look with a different perspective, and rates of 7% and above have been the norm. We have been below 7% only since 2000. That rates have done nothing other than go down seemingly forever is a bit of an illusion, because our eye goes to the horrific rates in the early 1980s, before Volcker took the helm. (Of course, that was during a period of inflation, so no surprise.) 😀

It is more like rates were around 7% or 8%, then exploded to double digits, and then came back to earth. We have been below 5% only post-2008. What else has happened post-2008? The Fed’s experiment with quantitative easing, when it quadrupled the money supply in just a few years. (After Covid hit, it printed more money in a few months than it had in the past two centuries. That might have been needed to keep the financial system from collapse, but it leads to inevitable results nonetheless.)

If you believe in JPM’s and Goldman’s prognostications, it looks like that party is about to end. As it should, because although It has been the norm now for a decade, it really is an experiment, not a policy,

A footnote: Why does a rise in rates affect the P/E ratio. Well, it actually shouldn’t have much of a direct effect, but there is an argument — a justification, really — for the high P/E level that with lower rates, the far-off earnings are not discounted as much, and so count for more on a present value basis. I don’t buy that, because the dividend discount model and Finance 101 courses notwithstanding, in real-life investors, don’t put much stock in earnings that are 15 or 20 years out. But if you do buy that argument, higher rates mean a lower P/E.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk