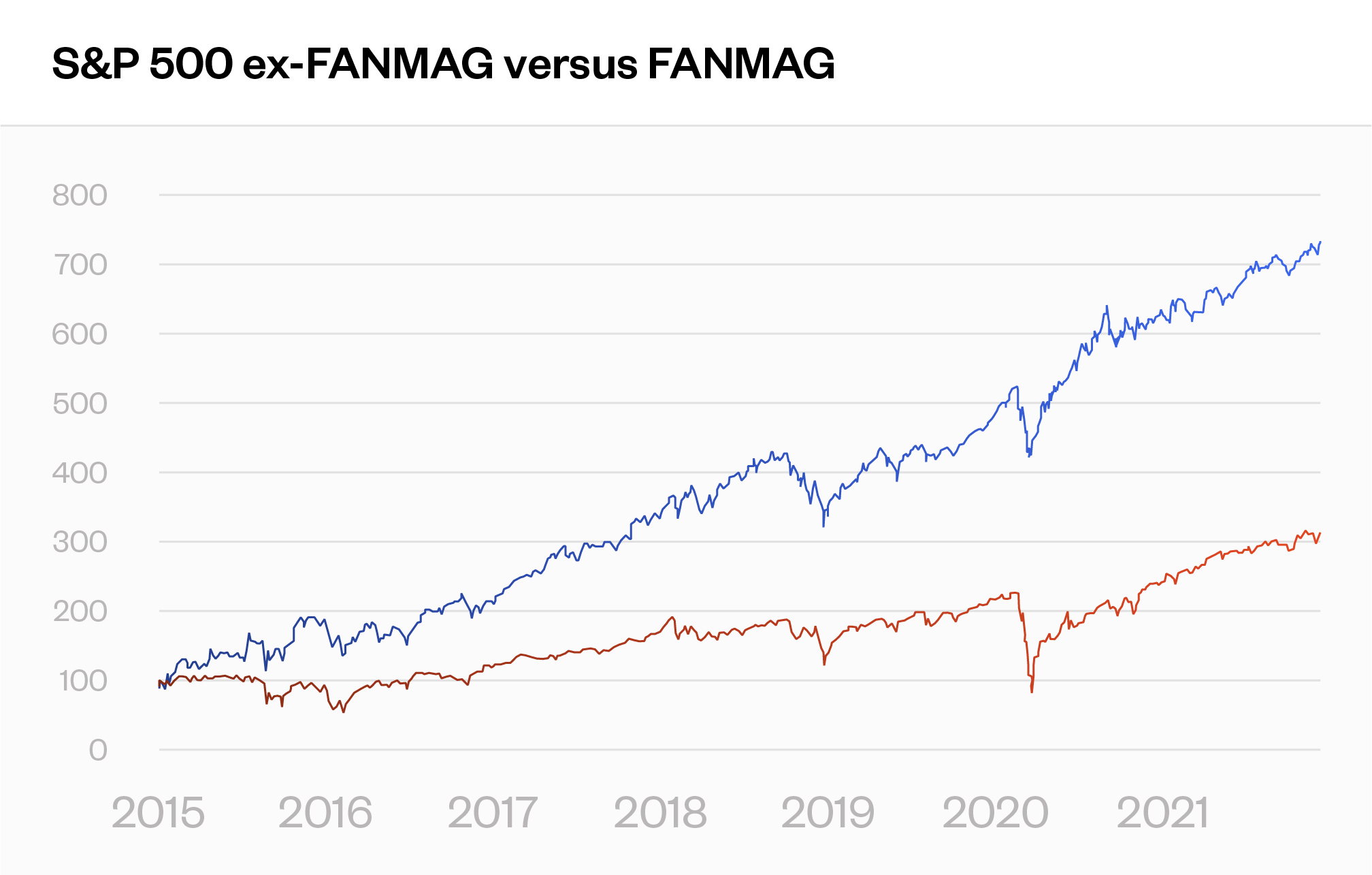

S&P 500 ex-FANMAG versus FANMAG

The market continues to chug along, and even if there are clear indications of vulnerability, risks don’t have to be realized today — or be realized at all.

We all get this, but just for old times’ sake, let’s go over the poster child for market vulnerability once again. Concentration and high valuations especially coming from technology. And in technology, specifically looking at FANMAG. (The redoubtable FAANG with Microsoft added in.)

There are any number of ways to put it — and some ways are more dramatic than others; in some constructions, the market is actually down when you take the top stocks out — but there are two facts of life for the market right now:

1. Huge concentration.

As shown in this chart, the top ten stocks make up 25% of the market cap for the S&P 500. (The top five make up almost 20%.) And it is a lot more dramatic for the Nasdaq.

.jpg)

2. Bifurcation in performance.

As this chart shows, the FANMAG have spectacular returns, lapping the also rans.

The market continues to chug along, and even if there are clear indications of vulnerability, risks don’t have to be realized today — or be realized at all. And I am risk- not performance-focused. But what is clear is that risk is building under the covers, and forward-looking risk is higher than in the past. So even absent prognostication, this is useful if you have a notion of volatility targeting — wanting to keep your portfolio risk in a determined range.

Source: Ned Davis Research

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk