Inflation, Inflation everywhere

While inflation has been surging everywhere in the developed world, central banks have been reticent to hike rates. Last week’s announcements however suggest that they have taken a less dovish turn.

Last week was a hectic one in terms of news from central banks. The three major central banks of the world — the Fed, the ECB, and the Bank of England — made announcements concerning their respective policy stances going forward. While each central bank oversees economic systems with their own idiosyncrasies, one thing was on everyone’s minds: Inflation (yes, even in Europe). Let’s break down all of this a bit.

The Fed

All eyes were on the Fed and speculation was rife about what Jay Powell would say. The backdrop is important: the latest CPI print showed inflation running at 6.2% year-over-year, the highest its been in over three decades. Chair Powell did signal that the Fed would reduce its asset purchases through next year, signaling the beginning of a tightening cycle.

This announcement along with the absence of the word "transitory” in the FOMC announcement has led many in the commentariat to suggest that the Fed has indeed taken a hawkish turn. That might not be the case. While the Fed didn't say that inflation is transitory, their thinking definitely suggests

Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation.

If it quacks like a duck, walks like a duck...

The central argument concerns real (inflation adjusted) rates. We will limit our analysis and comments to nominal rates. As shown in the graph above, the trend in rates has been somewhat consistent across different time periods. It is a remarkable finding given that the period considered spans everything from the Black Death, the fall of Constantinople, the discovery of the new world, the founding of the United States, the rise and fall of communism, and eventually to today. While there are periods within the data-set that show sharp shorter-term deviations from the trend, the truly provocative argument presented in the paper is that current rates are in fact consistent with a long-term "suprasecular" trend. Or as Schmelzing argues, "A Florentine trader in the 17th century would have been able to predict current low rates by looking if he had access to data from the preceding 3 centuries". It is to be noted that the data makes claims about long-term interest rates and is silent about the shorter end of the yield curve. Nonetheless, what lessons does it hold for the average investor.

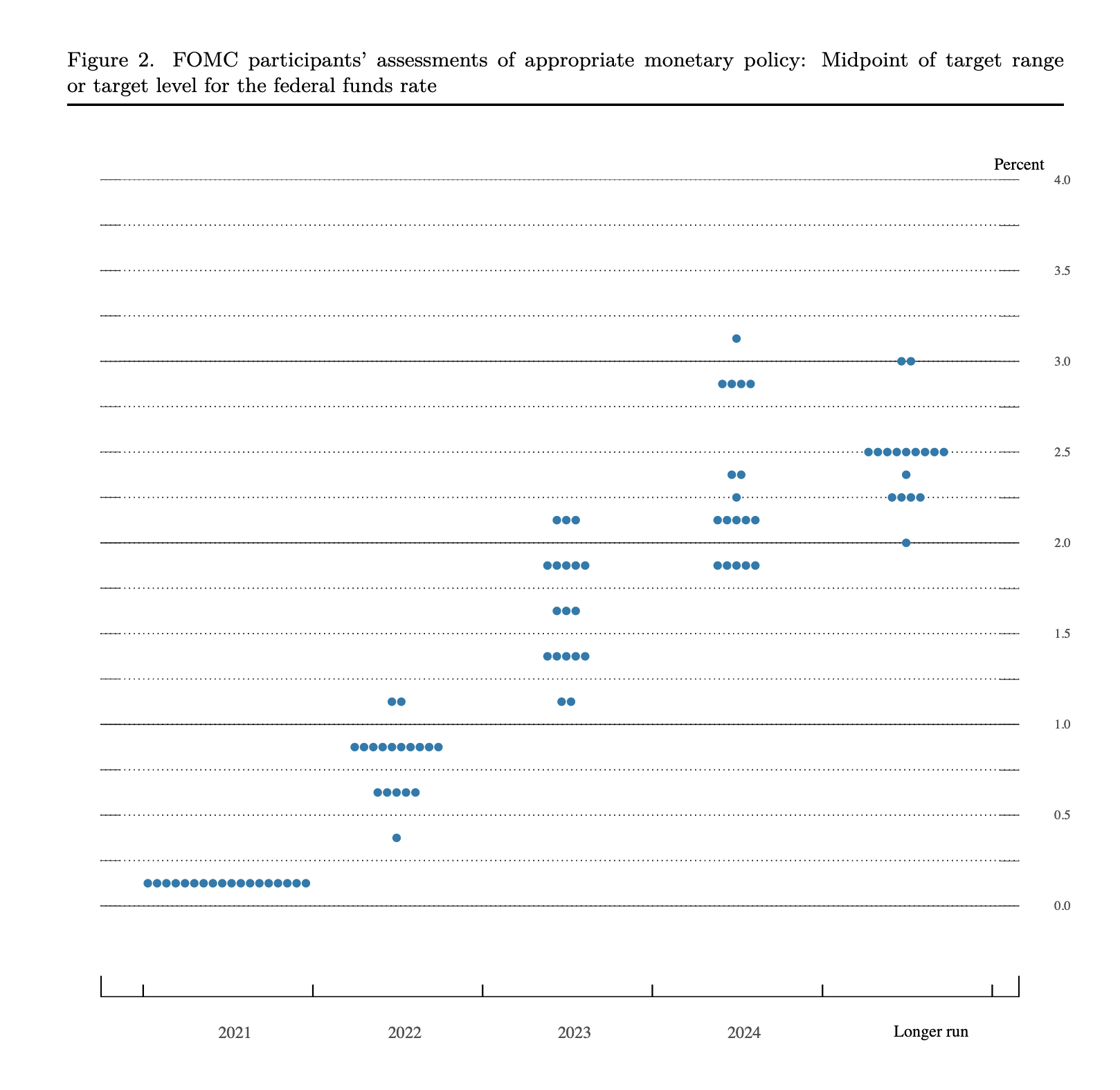

What about rate hikes? The confusing dot plot (above) from the same FOMC meeting suggests that there would be three interest rate increases over the course of the next year. However, all evidence suggests that this has already been priced in by the market. In some ways, this is a manifestation of what the former Governor of the Bank of England Mervyn King called the Maradona effect:

Maradona ran 60 yards from inside his own half beating five players before placing the ball in the English goal. The truly remarkable thing, however, is that, Maradona ran virtually in a straight line. How can you beat five players by running in a straight line? The answer is that the English defenders reacted to what they expected Maradona to do. Because they expected Maradona to move either left or right, he was able to go straight on

Here is the goal, aptly the goal of the century. King goes on,

Monetary policy works in a similar way. Market interest rates react to what the central bank is expected to do. .... These expectations were sufficient – at times – to stabilise private spending while official interest rates in fact moved very little.

Finally, what does it imply for the Fed’s new framework of Flexible Average Inflation Targeting (FAIT)? Within this new framework, “the Fed will seek inflation that averages 2% over a time frame that is not formally defined. This means that after long periods of low inflation, the Fed will not enact tighter monetary policy to prevent rates higher than 2%. One benefit of this flexible strategy to managing the mandate of price stability is that it will impose fewer restrictions on the mandate of full employment.’’

As chair Powell himself said “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

Thus this new framework is very much still guiding the Fed’s outlook.

The ECB

The European Central Bank’s announcements could be read to be slightly less dovish as they decided to scale back its 1.8 Trillion euro PEPP (Pandemic Emergency Purchase Programme). The projected end to this pandemic stimulus is March 2022. However, no rate hikes were announced and the older Asset Purchase Programme (APP) was in fact scaled back up from its monthly rate of 20 billion euros to 40 billion euros in the second quarter of 2022.

Over the last decade, inflation in the Eurozone has undershot the ECB’s 2% target, and this despite persistent quantitative easing over the same period. Over the course of 2021, as Europe has recovered from the pandemic, inflation within the Eurozone has however ticked back up to 4.9%. This latest number doesn’t seem to have effected the ECB’s thinking on whether to hike rates, perhaps taking caution from the experience of premature rate hikes following the 2008 financial crisis.

Bank of England

The most surprising move of all come from the Bank of England which decided to raise interest rates within the UK by 15 basis points. This comes as the newer Omicron variant surges throughout the country. Like the ECB, the BoE also has a mandate for maintaining inflation at 2%. The latest CPI print might have forced the BoE’s hands, even though it is unclear whether such a high rate of inflation could be sustained if the current surge in cases continues. The BoE clearly seems to think that the current surge in Covid cases is a short-term phenomenon and that over the medium-term there are structural reasons that can sustain inflation at levels higher than the mandated 2% level.

Surprise move from China

While major developed country central banks have taken a somewhat hawkish turn, in turn if not in actual practice, the People’s Bank of China has taken a different turn. Coming out of the initial shock of the lockdowns in early 2020, China’s recovery has been rather sluggish. To improve liquidity in the market, the PBOC cut the reserve ratio requirements for commercial banks by 50 basis points. More details here: https://www.scmp.com/economy/china-economy/article/3160429/chinas-first-benchmark-rate-cut-20-months-signals-serious

Signals for Investors?

How should individual investors factor these announcements into their decisions? While it is clear that inflation has been on top of everyone's mind, central banks are taking a cautious approach as far as rate hikes go. With the emergence of the Omicron variant, the pandemic is front and center for central banks. From this perspective, the risk going forward is the pandemic persisting and a start-stop economic recovery. How such an economic situation unravels for the markets and the inflation outlook is uncertain. Central Banks do however believe that inflation expectations are fairly well-anchored, as borne out with the market's expectations of future inflation. What is certain are the rate hikes announced in the dot-plot though the magnitudes of those hikes will be a function of how the Fed sees the labor market recovering.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk