Inflation: Sunny Weather is Bad News

The job market looks sunny and full of opportunity — for labor. For inflation, that is bad news.

The job market looks sunny and full of opportunity — for labor. For inflation, that is bad news. It is a factoid on the prospects for ongoing inflation from the cost-push side. And it is one that is important in the conversation for whether inflation will be transient or longer term.

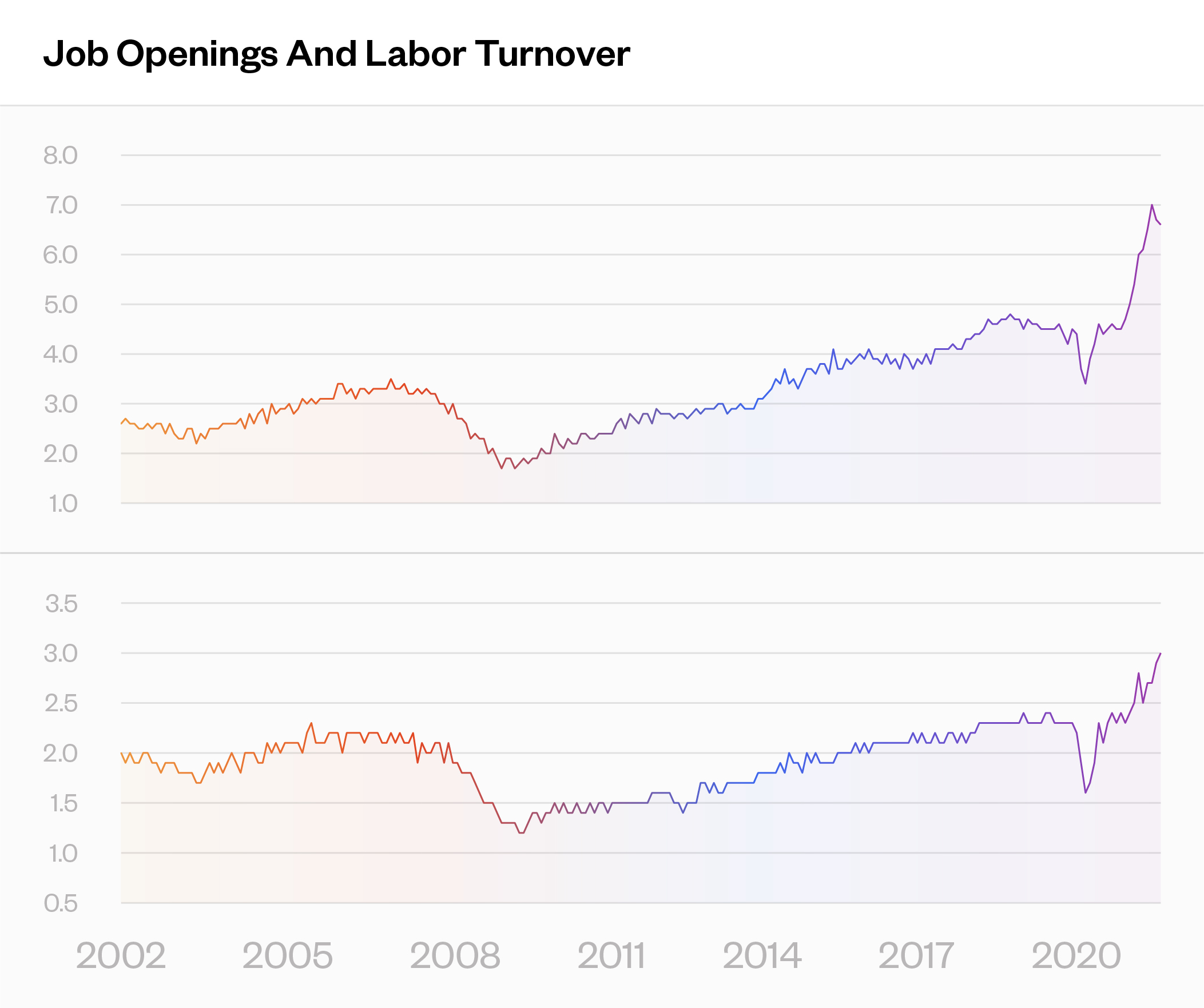

We know about the “great resignation” and $25 wages for McDonald’s. This chart on job openings and turnover makes the overall trend of these anecdotes crystal clear.

That we are talking about labor is of note because of the “ratchet effect”. The ratchet effect has taken on ever broader and technical meaning in academics (surprise), but the key point is one we all know: wages go up, but are sticky on the downside. They don’t adhere to the fluid price assumptions we are familiar with from our Econ 101 micro class: Here what goes up will rarely go down.

Of course, there is more going on than labor. Here is my sense of what factors to worry about — and what to key in on to benefit from, or at least buffer, inflation’s effects.

The point is that some factors will do better than others, and a portfolio constructed around those will likely do better as well. This is not about stocks directly, because different stocks will have different loadings on the critical factors.

First, the broad scale effects:

Interest rates, obviously, go up.

Credit spreads widen. More stress for some companies that can’t pass through costs, and spreads widen when interest rates rise.

Now the factor effects:

Companies with high leverage will be in the negative territory. Leverage looks at long-term debt, but we can assume a need to roll it, and it will be done at a higher cost, both due to rates and credit spreads.

Size is a positive. Higher size means more market power, and so costs can be kept down, and in some cases price can be raised. Low size means cost takers. So hurt more

Value is a negative. This is a little iffy. My argument is that value often means brick and mortar, and a cost structure wedded to real factors of production. By contrast, high growth tends to be biased toward companies driven by intangibles.

Some argue that growth is hurt because high rates discount earnings further out. But (a) inflation effects are not expected to persist long-term, and (b) although Finance 101's dividend discount model counts the present value of distant earnings, the reality is that investors don’t really think about longer-term earnings because they know anything can happen between now and then.

The ultimate start of the supply chain.

For the same reason, basic material sectors are a positive. So Materials, chemicals. They can change prices.

Intangibles is a positive. So Information technology. They do not have as much in terms of “real” costs.

Image Source: Bureau of Labor Statistics

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk