Risk for Credit Investments

Credit risk is difficult to gauge based on what is happening day to day. But it is an area of growing concern.

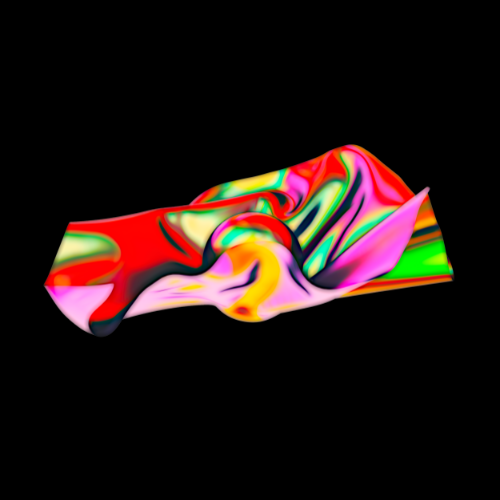

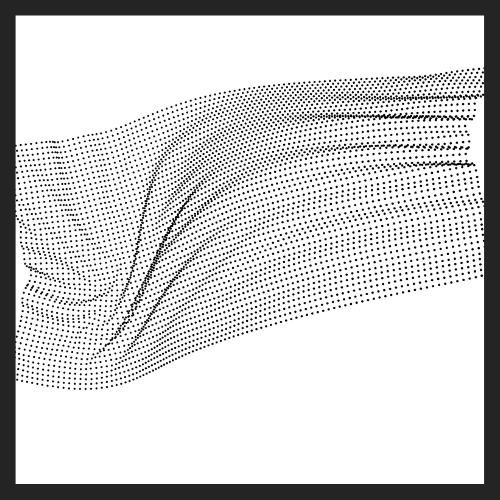

If there is a credit event, there is a lot of room for credit investments to run off the tracks. When you take inflation into account, the rates for corporate bonds are at an all-time low. Even without an inflation adjustment, they are near the all-time low. You can see this in the two charts accompanying this post. First look at nominal bond yields in the top panel, then move them down by some measure of inflation from the bottom panel.

Even if the world returns to rational absent an event, corporate rates especially in the high yield bond market are going to rise substantially. “Substantially” can mean huge spreads over Treasuries. During large credit dislocations we have seen high yield spreads widen into double digits. Which of course means big losses for the bond holders. It also means a markdown for credit exposure elsewhere, but is most manifest in the high yield bond market because that is where you can get a mark-to-market for credit risks.

But you don’t even get a good read on risk there. The volatility in the bond market does not do a great job of manifesting risk because credit risk is of the “make a little…make a little…lose a lot” sort. Most of the time things look fine. Not much happens, volatility is low.

By the way, the total size of credit risk exposure is not fully evident because some of it resides in private equity. Private equity has seen a reduction of returns due to more money competing for opportunities, and so has turned more into private equity/credit. Often with the credit exposure opaque.

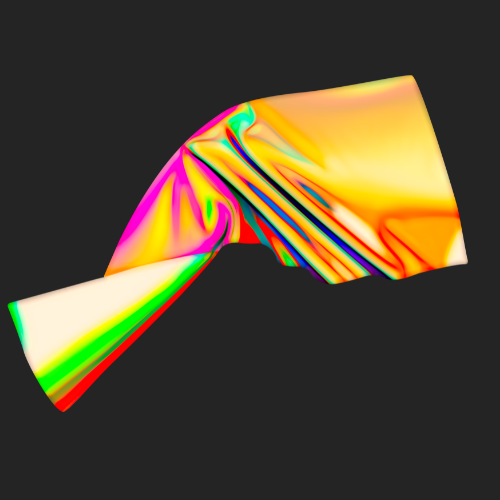

Access a better way to understand and work with risk, powered by MSCI’s factor model.

Rick Bookstaber

CO-FOUNDER AND HEAD OF RISK

Rick Bookstaber has held chief risk officer roles at major institutions, most recently the pension and endowment of the University of California. He holds a Ph.D. from MIT.

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk