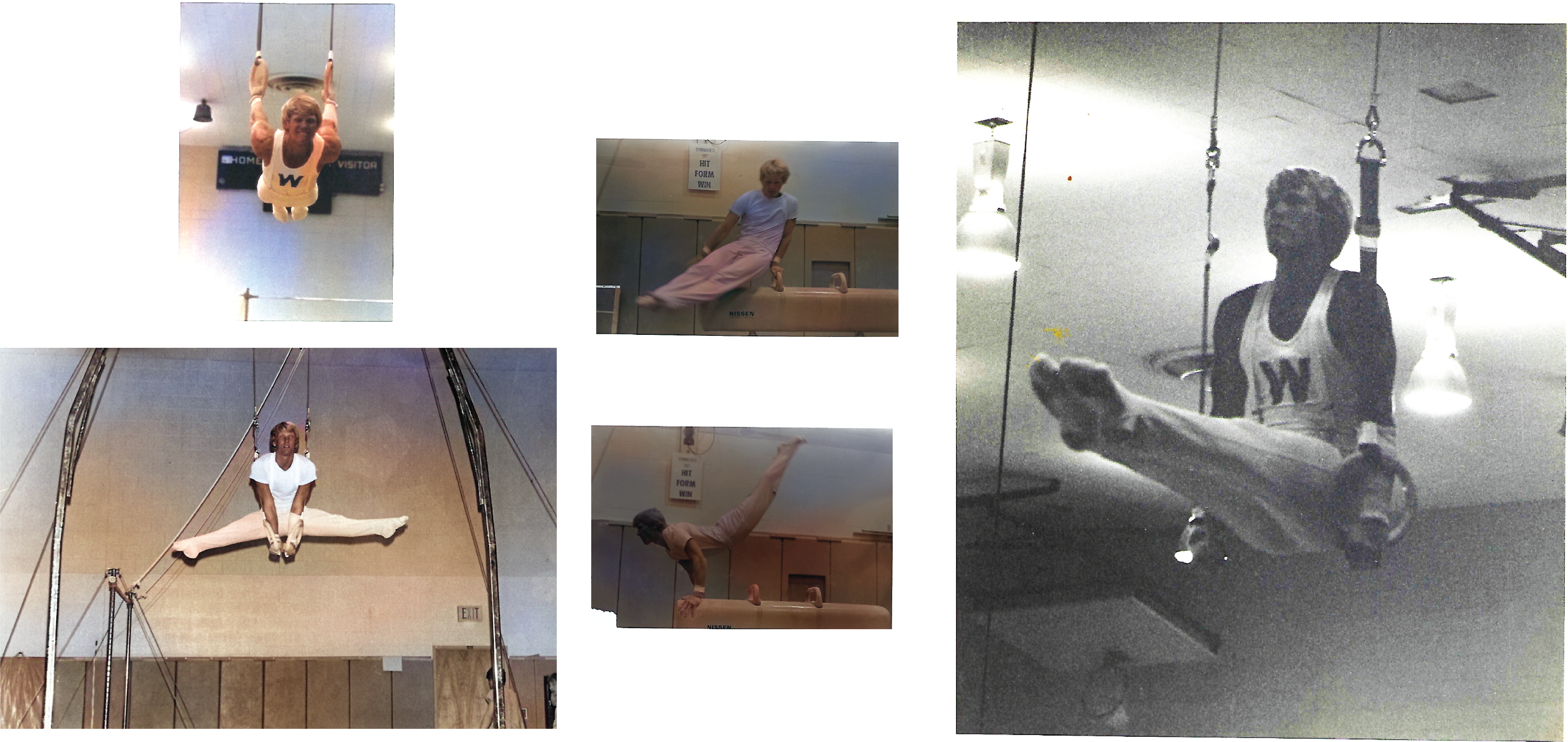

Client's "Spotter"

What level spotter are you for your clients?

As a former gymnast (yup…the guy with the laughable haircut is me in 1978) competing for the University of Wisconsin, I relied heavily on my teammates, coaches and trainers to ensure I was safe during particularly challenging routines. Risk is always high on the rings, floor and pommel horse routines. I was not an exceptional gymnast by any means compared to my esteemed teammates. As a result, I was extremely thankful to have vigilant, experienced and trusted individuals carefully watching my efforts to spot the potential moves taking me into a riskier paradigm. I learned also that risk cascaded once you had an “off moment” on the apparatus. I find it interesting in how my gymnastics experiences transitioned into some of my thinking and actions in my role as an advisor.

As I discussed in past posts, using your personal stories to connect can be quite useful. With my clients, I used my “gymnastics spotter analogy” in describing my role in designing, implementing and monitoring their portfolios. As advisors, we’re tasked with the most serious level of trust by proactively undertaking all our responsibilities to “spot” for trouble or risk that was not anticipated or sought to meet client goals. The best “advisor spotters” consistently seek the optimal methods to identify risk on every spectrum of portfolio management.

Advisors considering the multitude of risk permutations during various scenarios is as worthwhile as it is for gymnastics spotters to consider what might or could happen. The best gymnastics spotters’ factor in a plethora of possibilities and potential effects prior to and during routines. These include but are certainly not limited to the athlete’s current state of mind, current/potential injuries, level of athletic performance, routine difficulty level, equipment and even gym temperature.

So how do you fulfill your trusted advisor status as your client’s “spotter”?

Access a better way to understand and work with risk, powered by MSCI’s factor model.

© 2022 Fabric Risk